AEPS Full Form in Banking - Digiforum Space

Share

Facebook X LinkedIn Tumblr Pinterest Pocket Skype Messenger Messenger Viber

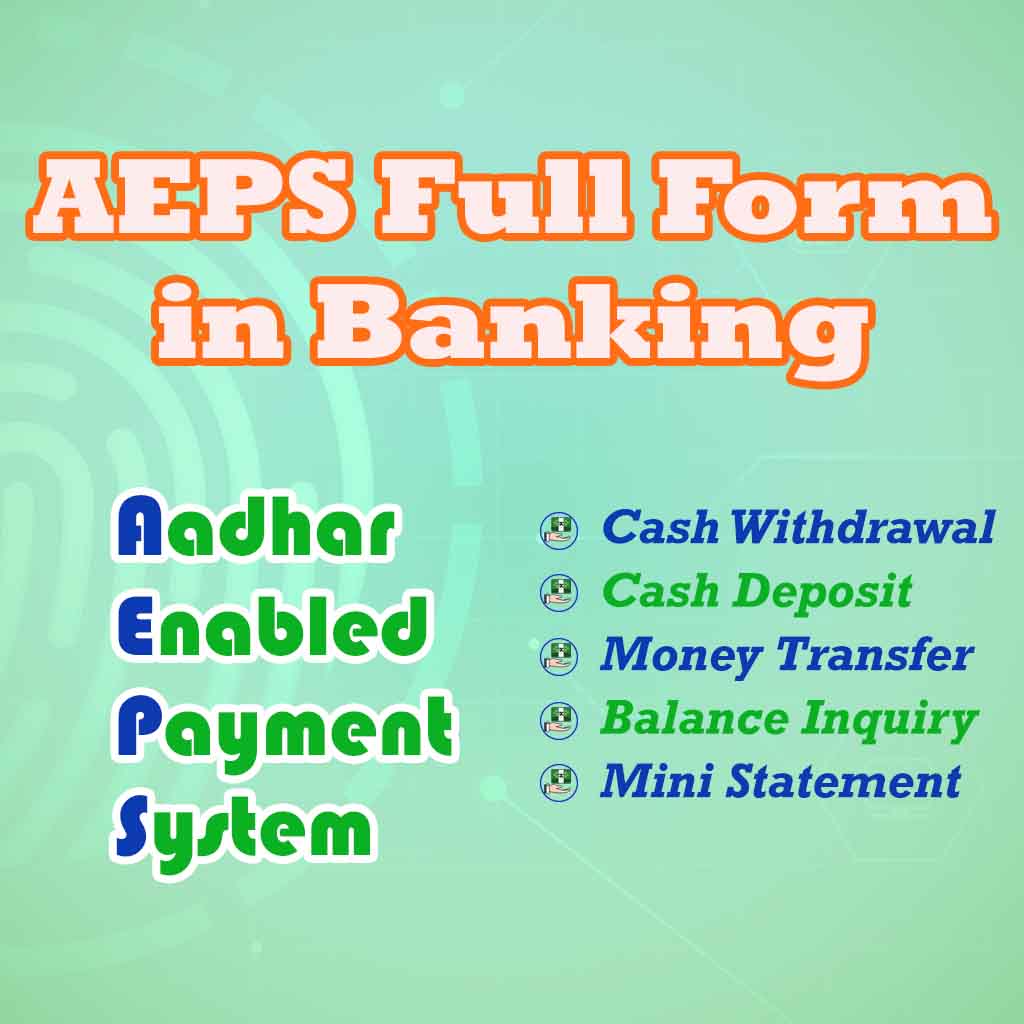

AEPS Full Form in Banking (Aadhaar Enabled Payment System)

AEPS Full Form: In the landscape of banking and finance, innovations are continually shaping the way we transact and access financial services. One such innovation that has revolutionized the banking sector is AEPS, which stands for “Aadhaar Enabled Payment System.” In this article, we will delve into the full form of AEPS in banking and explore its significance in bringing financial services to the masses.

What is AEPS?

AEPS, or “Aadhaar Enabled Payment System,” is an advanced banking system introduced by the Indian government to facilitate financial transactions using Aadhaar, a unique identification number issued to Indian residents. This system is designed to make banking services accessible to all, particularly in rural and remote areas, by leveraging the Aadhaar infrastructure.

How AEPS Works?

AEPS operates on a straightforward principle. It allows bank customers to access basic banking services by simply using their Aadhaar number and biometric authentication (fingerprint or iris scan). Here’s how it works:

- Aadhaar Authentication: To use AEPS, individuals need to link their Aadhaar number to their bank account. This linkage ensures that their Aadhaar is associated with their banking details.

- Biometric Verification: When conducting transactions, users visit a banking correspondent or business correspondent (commonly referred to as a BC or CSP) who has a Micro-ATM. They provide their Aadhaar number and undergo biometric verification through fingerprint or iris scanning.

- Transaction Processing: Once the biometric details are verified, users can perform various banking transactions, such as checking their account balance, depositing or withdrawing cash, and transferring funds to other accounts.

- Real-time Confirmation: After the transaction, a confirmation message is sent to the user’s registered mobile number, providing details of the transaction.

Key Benefits of AEPS

AEPS has several advantages that make it a crucial component of the Indian banking system:

- Financial Inclusion: AEPS plays a pivotal role in bringing unbanked and underbanked populations into the formal financial system, fostering financial inclusion across India.

- Accessibility: It ensures banking services are accessible even in remote areas with limited banking infrastructure. Individuals no longer need to travel long distances to access banking services.

- Security: Biometric authentication enhances security and reduces the risk of unauthorized transactions, ensuring the safety of individuals’ financial assets.

- User-Friendly: AEPS transactions are simple and user-friendly, making them accessible to people with varying levels of digital literacy.

Related Articles

- How AePS Works – Aadhar Enabled Payment System

- Link Aadhaar Number with Bank Account Online

- Paynearby Yes Bank CSP Registration Online

- Aadhaar Micro ATM Near Me

- UPI Meaning in Hindi – Full Form

Conclusion

AEPS, which stands for “Aadhaar Enabled Payment System,” is a transformative initiative that empowers individuals across India by granting them easy access to banking services through Aadhaar-based authentication. This innovative system has significantly contributed to financial inclusion and is a testament to India’s commitment to leveraging technology to enhance the lives of its citizens.

In an era where technology is rapidly changing the face of banking, AEPS stands out as a beacon of financial accessibility and security, ensuring that no one is left behind in the journey toward a financially inclusive India.

TagsAePS Basics RNFI ServicesCopy URL URL Copied

Send an email 08/02/20240 91 2 minutes read

Share

Facebook X LinkedIn Tumblr Pinterest Pocket Skype Messenger Messenger ViberShare

Facebook X LinkedIn Tumblr Pinterest Reddit VKontakte Odnoklassniki Pocket Skype Share via Email Print