Why do Banks freeze accounts? - Digiforum Space

Share

Facebook X LinkedIn Tumblr Pinterest Pocket Skype Messenger Messenger Viber

Why do Banks freeze accounts?

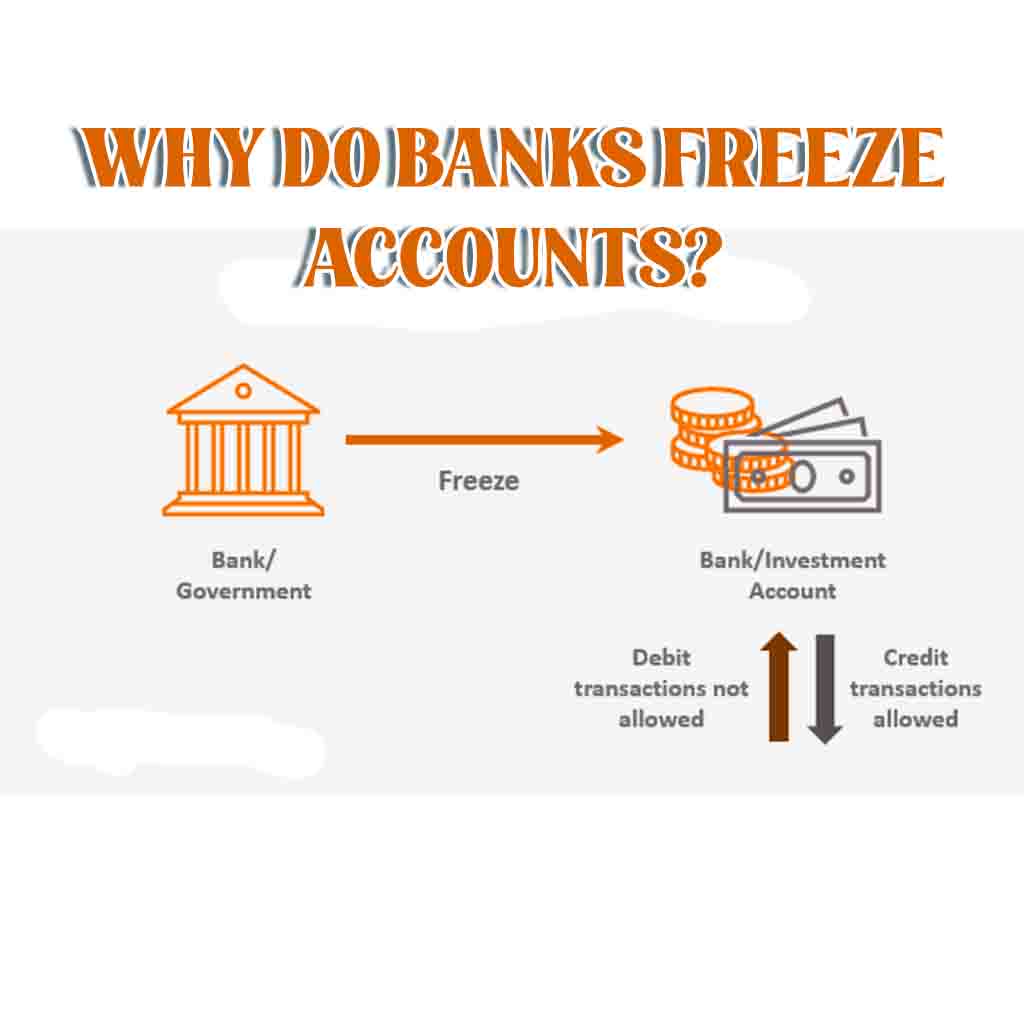

In India, the freezing of bank accounts is a practice that can be both confusing and distressing for individuals and businesses. Bank account freezing refers to the temporary suspension of account activities, including transactions and withdrawals. While it may seem alarming, this measure is taken by banks under specific circumstances to ensure regulatory compliance and maintain the integrity of the financial system. In this article, we will explore the reasons behind why banks freeze accounts in India and shed light on the important role this practice plays in safeguarding the financial ecosystem.

1. Non-Compliance with KYC (Know Your Customer) Norms

Banks in India are required to comply with the Reserve Bank of India’s (RBI) guidelines on customer identification and due diligence, commonly known as Know Your Customer (KYC) norms. Failure to provide accurate and updated KYC documents, such as proof of identity and address, can lead to the freezing of bank accounts. This measure ensures that banks have accurate customer information to prevent money laundering, fraud, and other illicit activities.

2. Suspected Fraudulent Activities

Banks have a responsibility to detect and prevent fraudulent activities within the financial system. If a bank suspects any fraudulent transactions or suspicious activities in an account, it may freeze the account temporarily. This freeze allows the bank to investigate the matter further to protect the account holder and prevent potential financial losses.

3. Legal or Regulatory Compliance

Banks are obligated to comply with various legal and regulatory requirements imposed by government agencies and financial authorities. In cases where there is a court order, government directive, or regulatory investigation related to an account holder, banks may freeze the account to comply with the legal or regulatory obligations. This measure ensures that the bank avoids any legal liability and upholds the integrity of the financial system.

4. Outstanding Debt or Loan Defaults

When an individual or business fails to repay their outstanding debts or loan installments, banks have the authority to freeze their accounts. This action is often taken as a last resort after exhausting other means of debt recovery. By freezing the account, banks aim to secure the funds necessary for debt repayment and protect their own financial interests.

Related Articles

- Freeze Account meaning in Hindi

- Amazon Pay later charges

- Online Payment banks in India

- Punishment for forex trading in India

- Buy Now Pay Later in EMI: Pros and Cons

Conclusion

While the freezing of bank accounts in India can cause inconvenience and anxiety, it is important to recognize the reasons behind this practice. Banks freeze accounts to ensure regulatory compliance, prevent fraudulent activities, comply with legal obligations, and recover outstanding debts. By implementing account freezing measures, banks play a crucial role in maintaining the integrity of the financial system and protecting the interests of both the account holders and the institutions themselves. It is advisable for individuals and businesses to adhere to the KYC norms, promptly address any suspected fraudulent activities, and fulfill their financial obligations to avoid any potential account freezing situations. In case of an account freeze, it is essential to communicate with the bank and provide the necessary documentation or information to resolve the issue and restore normal account activities promptly.

TagsBank Account Bank Account Frozen BankingCopy URL URL Copied

Send an email 28/06/20230 81 2 minutes read

Share

Facebook X LinkedIn Tumblr Pinterest Pocket Skype Messenger Messenger ViberShare

Facebook X LinkedIn Tumblr Pinterest Reddit VKontakte Odnoklassniki Pocket Skype Share via Email Print