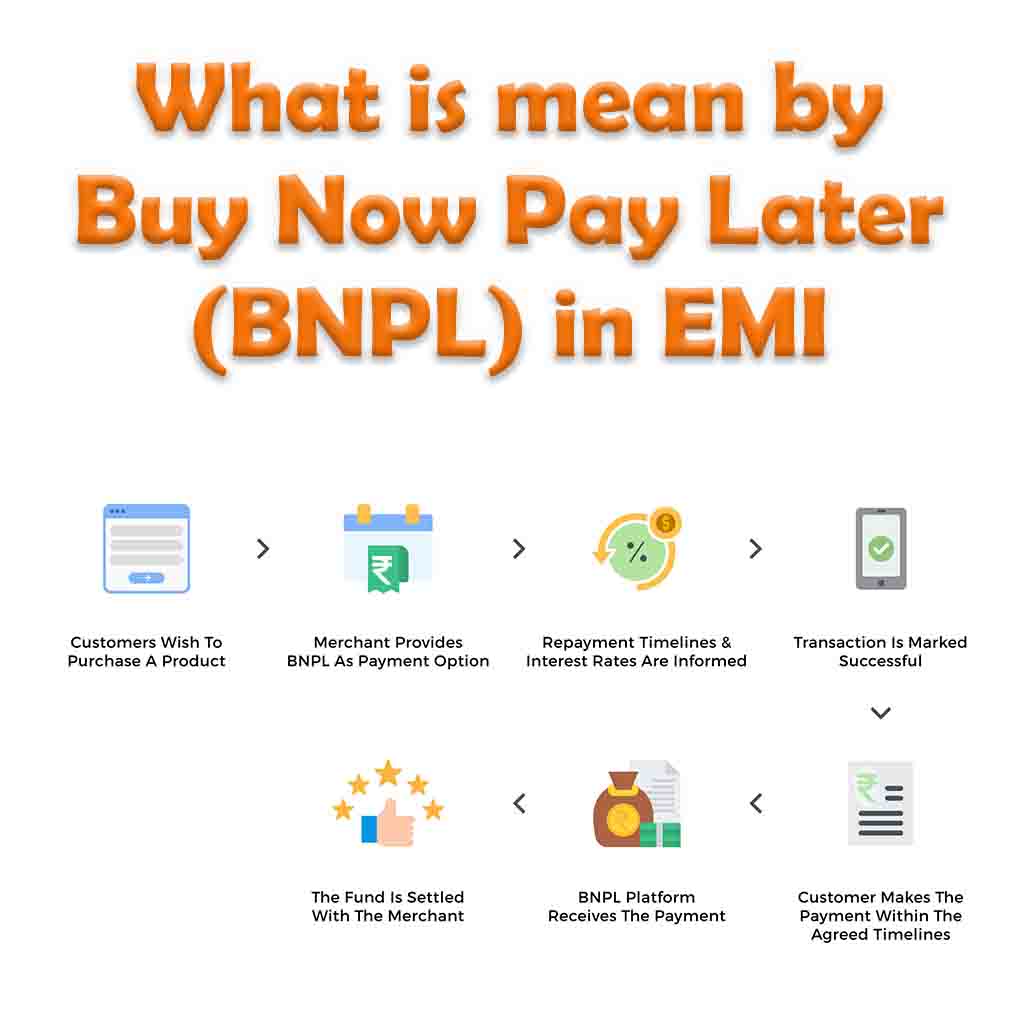

Buy Now Pay Later in EMI: Understanding the Pros and Cons

In recent years, Buy Now Pay Later (BNPL) options have become increasingly popular among consumers. These options allow shoppers to make purchases and pay them off over time, often with interest-free installments. One popular form of BNPL is the EMI, or Equated Monthly Installment, which lets shoppers spread out their payments over several months. While BNPL in EMI can be a convenient way to make purchases, there are both pros and cons to consider before using this payment method.

Pros of Buy Now Pay Later in EMI

- Flexibility: BNPL in EMI offers shoppers more flexibility in their purchasing decisions. They can choose to pay for expensive items over several months instead of all at once, making the purchase more manageable and affordable.

- No Interest: Many BNPL options offer interest-free installments, meaning shoppers can spread out their payments without having to pay additional interest charges. This can be a great way to make purchases without incurring extra costs.

- Easy Application: Applying for BNPL in EMI is often quick and easy. Many retailers and online stores offer this payment option at checkout, and the application process can be completed within minutes.

- Instant Gratification: With BNPL in EMI, shoppers can take their purchases home or have them shipped right away, without having to wait until they have saved up enough money to make the full payment.

Cons of Buy Now Pay Later in EMI

- Interest Charges: While many BNPL options offer interest-free installments, others charge interest rates that can be higher than those of credit cards. If shoppers do not pay off their purchases within the allotted time frame, they may end up paying more than they would have with other payment methods.

- Hidden Fees: Some BNPL options may have hidden fees, such as processing fees, late fees, or prepayment fees. Shoppers should read the terms and conditions carefully to understand all the costs associated with their purchase.

- Debt Accumulation: BNPL in EMI can be a slippery slope for some shoppers. If they take advantage of this payment option too often, they may accumulate debt that they cannot afford to pay off, leading to financial difficulties.

- Credit Score Impact: Late or missed payments on BNPL in EMI purchases can negatively impact shoppers’ credit scores, making it harder for them to obtain credit in the future.

Related Articles

Conclusion

Buy Now Pay Later in EMI can be a convenient way to make purchases without breaking the bank. However, shoppers must carefully consider the pros and cons before using this payment method. If they are responsible with their payments and avoid accumulating debt, BNPL in EMI can be a useful tool for managing their finances. However, if they do not fully understand the costs and risks associated with this payment option, it may end up costing them more than they bargained for.