What is Navi Loan App? - Digiforum Space

Share

Facebook X LinkedIn Tumblr Pinterest Pocket Skype Messenger Messenger Viber

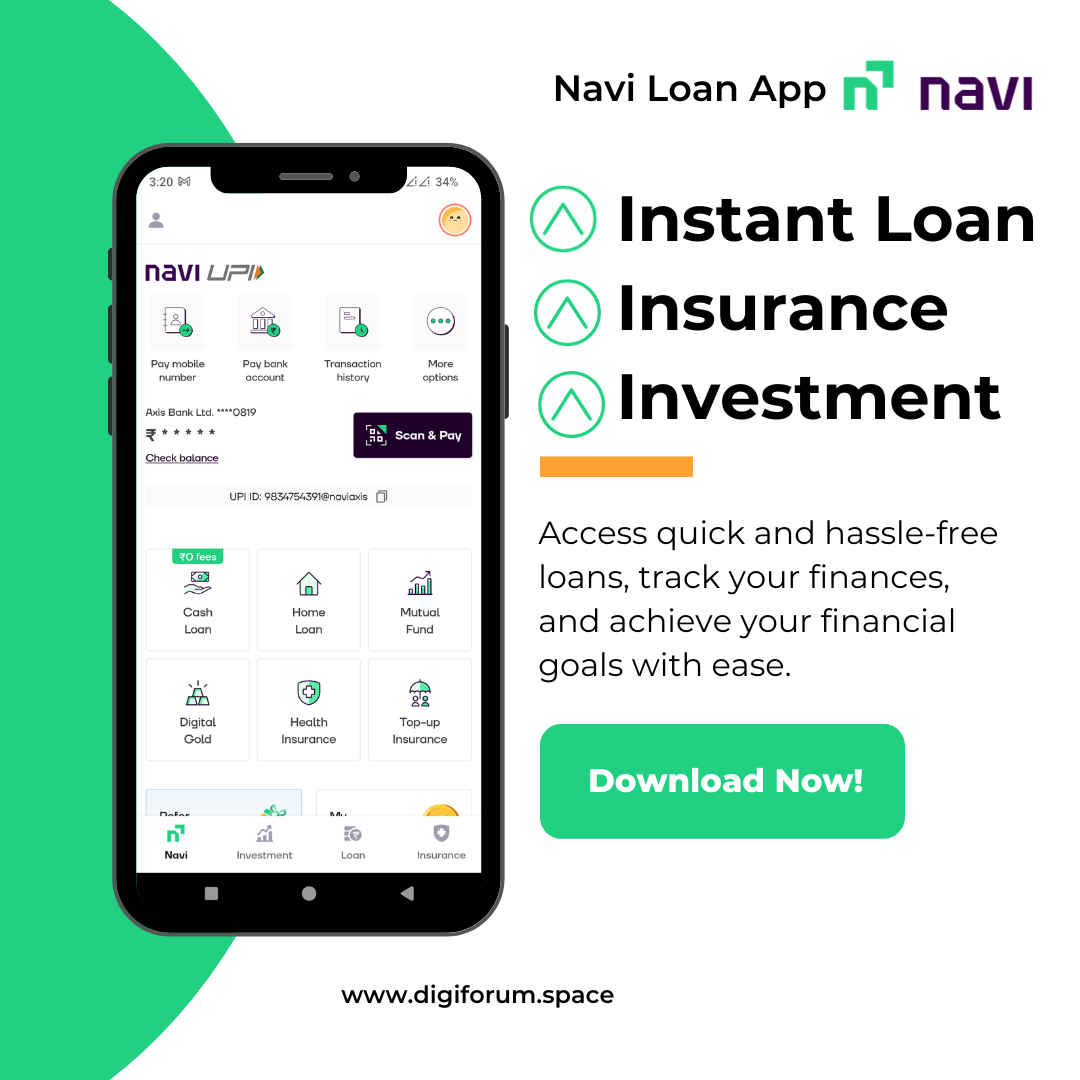

What is Navi Loan App?: Your Gateway to Quick and Convenient Loans

In a world where financial needs can arise unexpectedly, having access to quick and reliable loan options can be a game-changer. Navi, a prominent name in the fintech sector, offers a mobile loan app designed to provide individuals with easy access to personal loans. In this article, we’ll demystify the Navi loan app, exploring its features, benefits, and how it can be a valuable financial resource in your time of need.

What is the Navi Loan App?

The Navi loan app is a user-friendly mobile application that offers personal loans to eligible individuals. It’s a product of Navi Technologies, a fintech company founded by Sachin Bansal, co-founder of Flipkart, one of India’s largest e-commerce platforms. Navi’s mission is to simplify financial services and make them accessible to a broader audience.

Navi Referral Code/Link

How to earn rewards with Navi?

✅ Install Navi, use link below✅ Take Cash Loan ➡ win flat ₹500 cash reward✅ Buy Digital Gold ➡ win extra gold upto ₹100✅ Complete KYC for Mutual Funds ➡ win upto ₹250 cash reward🤔 Why use Navi?Get Cash Loans with 0️⃣ ZERO processing fee and Choose your EMI date 📅🟢 Start investing with just ₹1 🤯🟡 Digital Gold of 99.5% purityDownload Now:

Download NowKey Features of the Navi Loan App

- Instant Loan Approval: It boasts quick and hassle-free loan approval processes. Eligible applicants can receive loan approvals within minutes.

- Flexible Loan Amounts: It offers personal loans with flexible loan amounts, catering to a range of financial needs, from small expenses to larger financial goals.

- Competitive Interest Rates: The app provides loans at competitive interest rates, ensuring that borrowers have access to affordable credit options.

- Paperless Application: Applying for a loan through the app is entirely paperless. Users can complete the application process digitally, eliminating the need for physical paperwork.

- Customizable Loan Tenures: Borrowers can choose loan tenures that align with their repayment capabilities, making it easier to manage loan repayments.

- Secure and Private: It prioritizes the security and privacy of user data. The app employs robust encryption and security measures to protect sensitive information.

- Transparent Terms and Conditions: Navi is committed to transparency. It provides clear terms and conditions, ensuring that borrowers are fully informed about their loan agreements.

- No Hidden Fees: Users of the Navi loan app do not encounter hidden fees or unexpected charges. The fee structure is transparent and user-friendly.

How Does the Navi Loan App Work?

Using the Navi loan app is straightforward. Here’s a simplified overview of how it works:

- Download and Install: Start by downloading the Navi loan app from your device’s app store. It’s available for both Android and iOS.

- Registration: Register on the app by providing your basic details and verifying your identity.

- Check Eligibility: The app will assess your eligibility for a loan based on your information and credit profile.

- Choose Loan Amount and Tenure: Select the loan amount you need and the repayment tenure that suits you.

- Submit Application: Complete the loan application process by providing necessary documents and details.

- Loan Approval: If you meet the eligibility criteria, your loan application will be processed, and you’ll receive an approval decision.

- Receive Funds: Once approved, the loan amount will be disbursed directly to your bank account.

- Repayment: Make timely repayments as per the agreed-upon schedule through the app.

Benefits of Using the Navi

- Convenience: The app offers a convenient and user-friendly way to apply for and manage loans without the need for physical visits to a bank or lender.

- Speed: Navi’s efficient processes allow for quick loan approvals and disbursals, addressing urgent financial needs.

- Flexibility: Borrowers have the flexibility to choose loan amounts and tenures that match their financial goals and repayment capacity.

- Transparency: Navi is transparent about its terms and fees, ensuring that borrowers understand their loan agreements.

- Security: The app prioritizes the security and privacy of user data, employing encryption and security measures to protect sensitive information.

Related Articles

- Is Navi Loan App Safe? 20 Reasons to Trust

- Navi Loan App: Separating Fact from Fiction – Is it Fake or Real?

- Quick Money is the Term Associated with HDFC Bank

- Mobikwik Payment Gateway

- Kya Retailer ID me Payment Gateway hona jaruri hai?

- Instant loan App without Credit Score

Summary

The Navi loan app is a valuable financial tool that simplifies the loan application and approval process. With its user-friendly interface, competitive interest rates, and commitment to transparency, It offers borrowers an efficient and secure way to access personal loans. Whether you have an urgent financial need or wish to fulfill a long-term goal, the app can be your trusted companion on your financial journey.

TagsInstant Instant Loan Personal LoanCopy URL URL Copied

Send an email 19/10/20230 78 3 minutes read

Share

Facebook X LinkedIn Tumblr Pinterest Pocket Skype Messenger Messenger ViberShare

Facebook X LinkedIn Tumblr Pinterest Reddit VKontakte Odnoklassniki Pocket Skype Share via Email Print