Banking

-

Banking And Finance

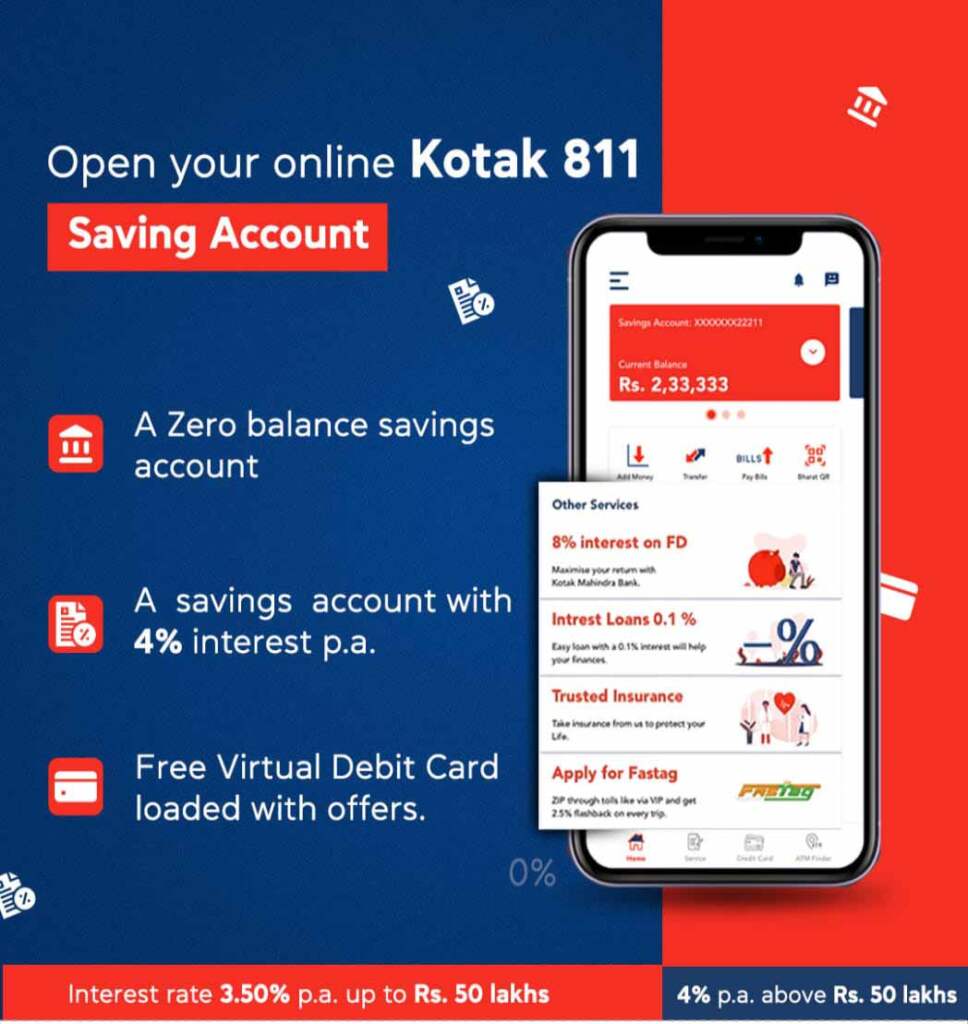

Kotak Mahindra Bank 811 Account Open

Kotak 811 Savings Account: Instantly Open a Zero Balance Savings Account and Unlock up to 4% Interest” Kotak Mahindra Bank 811 Account Open: In today’s fast-paced world, convenience is key, especially when it comes to managing our finances. That’s where digital banking comes into play, offering us the ease and flexibility we need. One such offering is the Kotak 811…

Read More » -

Banking And Finance

Under Liquidation meaning in Banking

Liquidation in Banking Liquidation is a term often associated with distress and financial turmoil. In the realm of banking, it carries significant weight and consequences. It’s a process that can impact not only financial institutions but also individuals and the broader economy. In this article, we will delve into the meaning of liquidation in banking, its implications, and provide a…

Read More » -

Banking And Finance

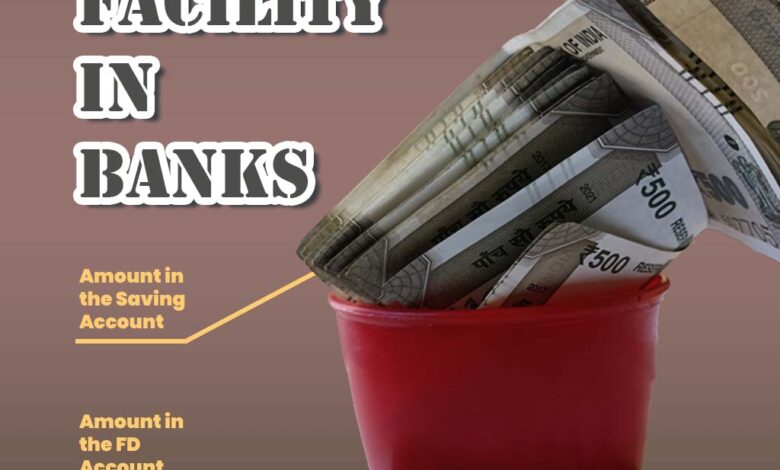

What is Auto Sweep Facility?

Unlocking the Power of Auto Sweep Facility: Maximizing Your Savings Effortlessly In today’s fast-paced world, financial planning and optimizing savings are crucial for individuals and businesses alike. One such tool that enables efficient money management is the Auto Sweep Facility. This innovative feature offered by banks in India allows account holders to earn higher interest rates on their idle funds…

Read More » -

Finance

How to Unfreeze Bank Account?

A Step-by-Step Guide: How to Unfreeze Your Bank Account Discovering that your bank account has been frozen can be a frustrating and stressful experience. However, it’s important to remain calm and take the necessary steps to unfreeze your account. The freezing of a bank account typically occurs due to various reasons such as non-compliance with regulations, suspected fraudulent activities, or…

Read More » -

Finance

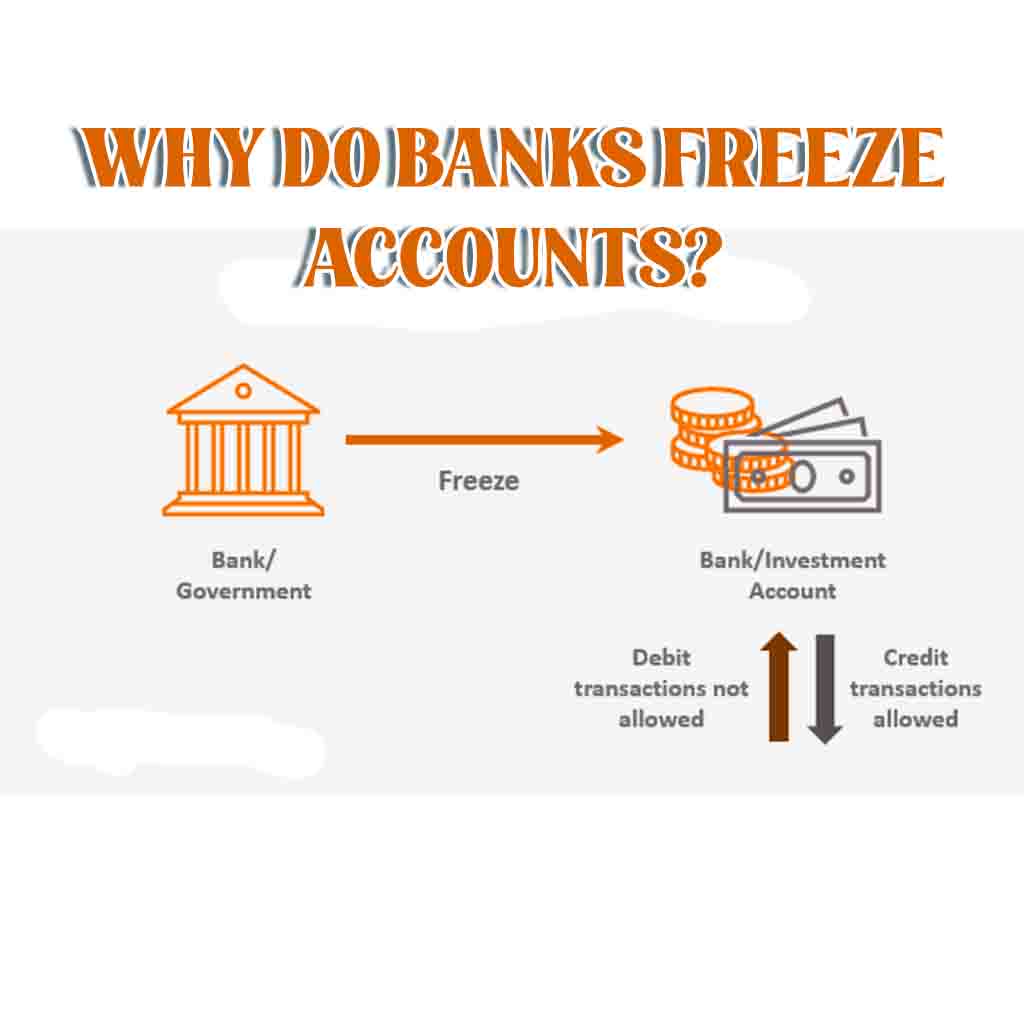

Why do Banks freeze accounts?

Why do Banks freeze accounts? In India, the freezing of bank accounts is a practice that can be both confusing and distressing for individuals and businesses. Bank account freezing refers to the temporary suspension of account activities, including transactions and withdrawals. While it may seem alarming, this measure is taken by banks under specific circumstances to ensure regulatory compliance and…

Read More » -

Finance

Check the financial health of your bank with these 8 ratios in India

Check the Financial Health of Your Bank with These 8 Ratios in India Check the financial health of your bank : Ensuring the financial stability of your bank is essential for safeguarding your hard-earned money. While banks are subject to regulatory oversight, it’s crucial to have a basic understanding of their financial health. One way to assess this is by…

Read More » -

Banking And Finance

Banking Awareness in Hindi

Banking Awareness in Hindi Banking Awareness का Hindi में अर्थ होता है – “बैंकिंग जागरूकता”। ये एक बहुत ही महत्वपूर्ण विषय है, जो न केवल जनरल अवेयरनेस सेक्शन को क्रैक करने में काम आता है बल्कि इंटरव्यू को भी क्रैक करने में सभी बैंकिंग उम्मीदवारों के लिए यूजफुल होता है। इंटरव्यूवर को कैंडिडेट्स से यही Candidate से expect किया जाता…

Read More » -

Banking And Finance

Freeze Account meaning in Hindi

Freeze Account meaning in Hindi बैंक खाता कई वजहों से Freeze हो सकता है। कभी किसी विधायी कार्य की वजह से, कभी Income tax डिपार्टमेंट तो कभी अदालती आदेश से भी बैंक खाते फ्रीज होते हैं। जब आप बैंकिंग ट्रांसक्शन करना चाहते है और आपको पता लगता है की आपका बैंक अकाउंट फ्रीज हो चूका है, तब आप परेशानी में…

Read More » -

Banking And Finance

Zero balance saving account

Zero balance saving account A zero balance savings account is a type of bank account that does not require a minimum balance to be maintained in the account. It is an account that can be opened and operated with a zero balance, and no charges are levied for non-maintenance of the account. The objective of this account is to make…

Read More » -

Banking And Finance

What is Bank Sathi App – Loans

What is Bank Sathi App? Bank Sathi App में रजिस्ट्रेशन करके आप भी एक फाइनेंसियल या Insurance Advisor बन सकते है। यह एक ऐसा यह ऍप जिसमे आप जीरो Investment करके ज्वाइन कर सकते है और अनलिमिटेड कमाई कर सकते है। इस आप के माध्यम से आप अपने ग्राहकों को Personal Loan प्रोडक्ट्स, इन्शुरन्स प्रोडक्ट्स, क्रेडिट कार्ड्स आदि वित्तीय उत्पाद बेच…

Read More »