Unlocking the Power of Auto Sweep Facility: Maximizing Your Savings Effortlessly

In today’s fast-paced world, financial planning and optimizing savings are crucial for individuals and businesses alike. One such tool that enables efficient money management is the Auto Sweep Facility. This innovative feature offered by banks in India allows account holders to earn higher interest rates on their idle funds while maintaining liquidity. In this article, we will delve into the concept of the Auto Sweep Facility, how it works, its benefits, and considerations for making the most of this feature.

What is Auto Sweep Facility?

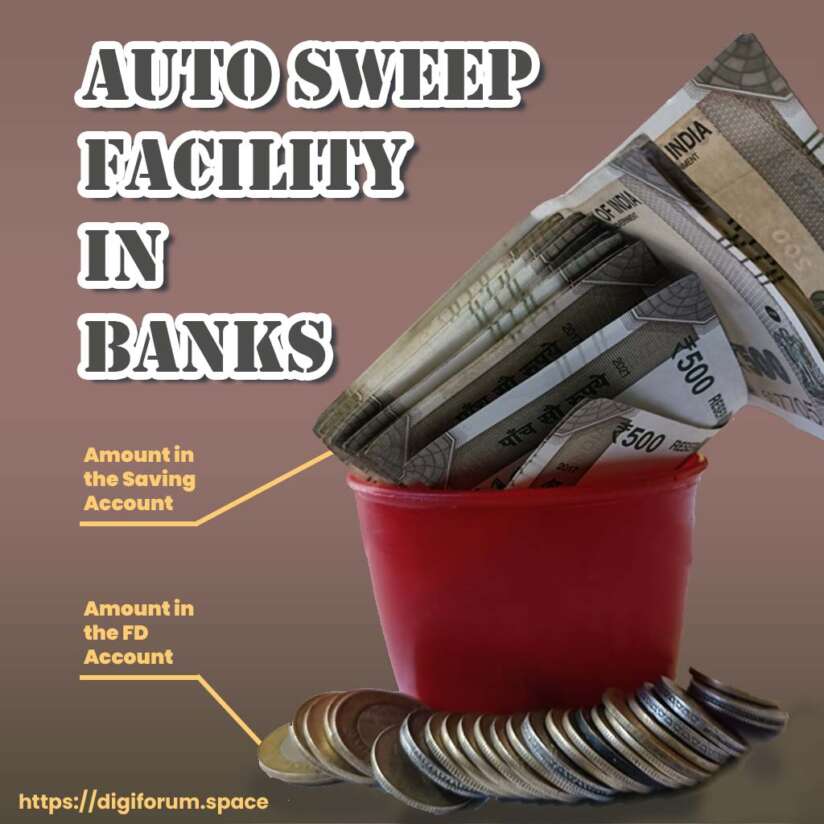

The Auto Sweep Facility, also known as a sweep-in or sweep-out facility, is an automated process that allows individuals to maximize their savings by combining the features of a savings account and a fixed deposit (FD). It is primarily designed for account holders who maintain a significant amount of funds in their savings account that are not immediately required for regular expenses.

Related Articles

How Does It Work?

Threshold Amount: When setting up the Auto Sweep Facility, you need to specify a threshold amount. This amount determines the minimum balance that should be maintained in your savings account. Any funds exceeding this threshold are automatically transferred to a fixed deposit account.

Sweep-In: As the name suggests, the Auto Sweep Facility “sweeps” the excess funds from the savings account into the linked fixed deposit account. The swept-in amount is considered as an FD investment, which typically earns a higher interest rate compared to the savings account.

Liquidity: Despite the transfer of funds to the fixed deposit, the Auto Sweep Facility ensures that you maintain liquidity. When you need to access funds beyond the threshold amount, the system automatically initiates a “sweep-out” process, transferring the required amount back to the savings account. This enables seamless liquidity management without compromising on the interest earned.

Benefits of Auto Sweep Facility:

- Higher Interest Rates: One of the significant advantages of the Auto Sweep Facility is the ability to earn higher interest rates on idle funds. Instead of letting your money sit idle in a savings account, it gets automatically invested in an FD, where it can earn more attractive returns.

- Flexibility and Liquidity: The Auto Sweep Facility strikes a balance between earning higher interest rates and maintaining liquidity. You have access to your funds whenever needed, as the system automatically transfers the required amount back to the savings account.

- Convenience and Automation: With the Auto Sweep Facility, you don’t need to manually monitor and transfer funds between accounts. The process is automated, saving you time and effort in managing your savings effectively.

Considerations for Maximizing the Auto Sweep Facility:

- Threshold Amount: Set an appropriate threshold amount based on your financial requirements and spending patterns. It should be a balance between ensuring sufficient liquidity for daily expenses and maximizing the interest earned through the FD.

- Minimum FD Amount: Be aware of the minimum amount required to open an FD and ensure that the swept-in funds meet this criterion. It may vary depending on the bank and type of FD chosen.

- Interest Rates and Tenure: Understand the interest rates and tenure associated with the FD component of the Auto Sweep Facility. Compare the rates offered by different banks to choose the one that provides the most favorable terms.

- Tax Implications: Keep in mind the tax implications of the interest earned from the FD component. Interest income is subject to tax, so consider the impact on your overall tax liability.

List of Auto Sweep Facility Provider Banks in India

Here is a list of banks in India that provide Auto Sweep Facility:

- State Bank of India (SBI)

- HDFC Bank

- ICICI Bank

- Axis Bank

- Punjab National Bank (PNB)

- Bank of Baroda (BoB)

- Canara Bank

- Union Bank of India

- Bank of India (BOI)

- IDBI Bank

- Indian Bank

- Central Bank of India

- Kotak Mahindra Bank

- Yes Bank

- IndusInd Bank

- Federal Bank

- Karnataka Bank

- Karur Vysya Bank

- Tamilnad Mercantile Bank (TMB)

- South Indian Bank

Please note that this list is not exhaustive, and there may be other banks in India that also provide the Auto Sweep Facility. It’s advisable to check with your preferred bank for specific details and terms regarding their Auto Sweep Facility offerings

Conclusion:

The Auto Sweep Facility is a powerful tool for optimizing savings and maximizing interest earnings while maintaining liquidity. By utilizing this feature, individuals can ensure that their idle funds work harder for them, earning attractive returns without compromising on accessibility. It is essential to understand the mechanics of the Auto Sweep Facility, set appropriate thresholds, and consider factors such as interest rates, minimum FD amounts, and tax implications to make the most of this financial tool. Embrace the Auto Sweep Facility and unlock the potential of effortless savings management to achieve your financial goals.