Kotak Mahindra Bank 811 Account Open - Digiforum Space

Share

Facebook X LinkedIn Tumblr Pinterest Pocket Skype Messenger Messenger Viber

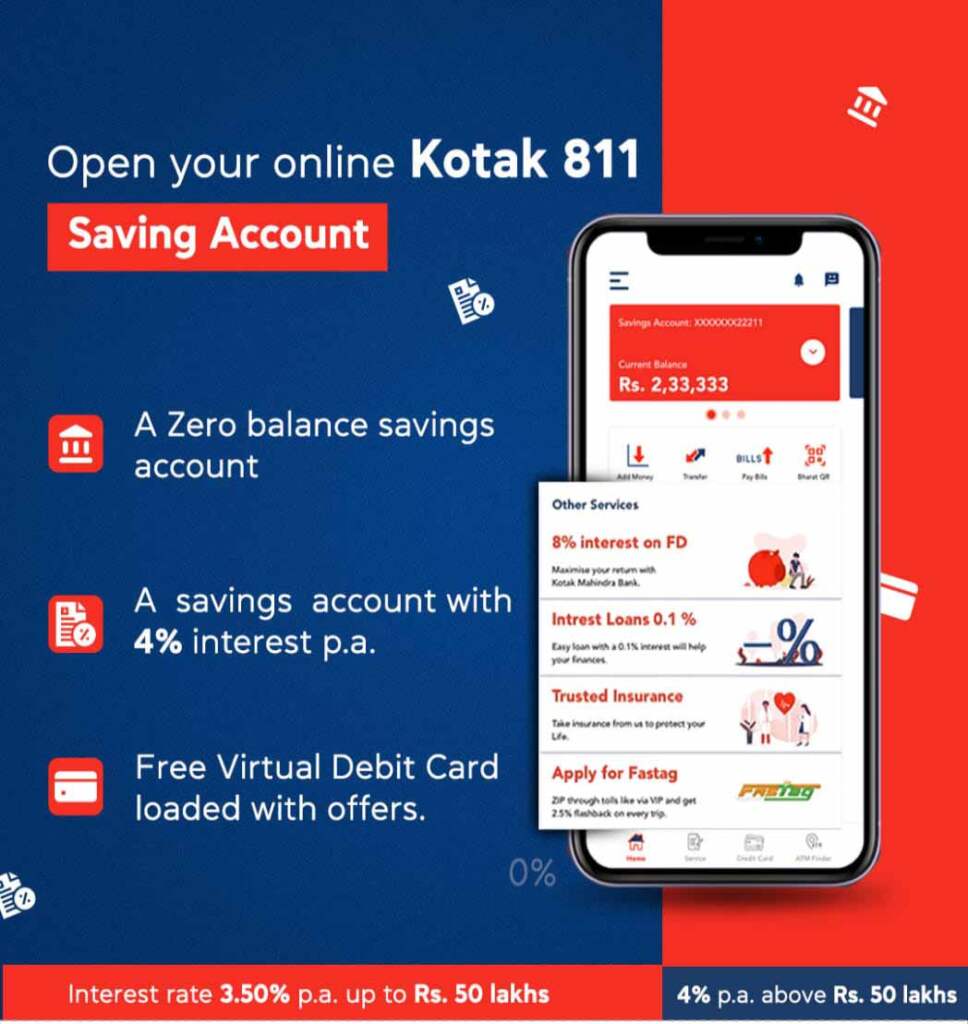

Kotak 811 Savings Account: Instantly Open a Zero Balance Savings Account and Unlock up to 4% Interest”

Kotak Mahindra Bank 811 Account Open: In today’s fast-paced world, convenience is key, especially when it comes to managing our finances. That’s where digital banking comes into play, offering us the ease and flexibility we need. One such offering is the Kotak 811 Savings Account, a zero balance savings account that promises instant account opening and the opportunity to earn up to 4% interest. In this article, we will delve into the features, benefits, and convenience of Kotak 811, and why it might be the right choice for you.

The Evolution of Banking: Kotak 811

Traditional banking has its merits, but it often comes with lengthy paperwork, minimum balance requirements, and time-consuming processes. Recognizing the need for a more streamlined approach, Kotak Mahindra Bank introduced the 811 Savings Account, a fully digital offering that brings banking to your fingertips.

Key Features of Kotak 811 Savings Account

1. Zero Balance Account

Kotak 811 breaks away from the traditional norm of requiring a minimum balance in your savings account. With zero balance requirements, you can open your account without the worry of maintaining a certain sum.

2. Instant Account Opening

Gone are the days of waiting for your account to be approved. With Kotak 811, you can complete the account opening process within minutes, all from the comfort of your home. No more long queues or endless paperwork.

3. Virtual Debit Card

As soon as your account is opened, you receive a virtual debit card that you can use for online transactions immediately. You can also opt for a physical debit card if needed.

4. High-Interest Rate

One of the most compelling features of Kotak 811 is the opportunity to earn up to 4% interest on your savings. This rate is competitive and helps your money grow while it sits in your account.

5. Mobile Banking App

Kotak’s mobile banking app is user-friendly and feature-packed. You can easily manage your account, pay bills, transfer funds, and access a range of other banking services through the app.

How to Open a Kotak 811 Savings Account

- Download the Kotak Mobile Banking App from your app store.

- Click on “811 Digital Bank Account.”

- Fill in your details, including Aadhar and PAN, and complete the KYC process via video call.

- Once your account is opened, you can start using it right away.

Who Can Benefit from Kotak 811?

Kotak 811 is a versatile solution suitable for various individuals:

- Young Professionals: Ideal for those starting their careers who may not have substantial savings yet.

- Students: A great choice for students who need a simple and efficient banking solution.

- Freelancers and Gig Workers: Freelancers can benefit from the flexibility and convenience of Kotak 811.

- Tech-Savvy Individuals: Those comfortable with digital banking will find Kotak 811 a breeze to use.

Related Articles

- Kotak 811 Account Opening Online

- UPI Charges Rs. 5 After 20 Transaction a Month

- Zero balance saving account

- Benefits of Opening an Online Bank Account with Zero Balance

- Online Instant Cash Loans Apps

Conclusion

In a world that’s becoming increasingly digital, the Kotak 811 Savings Account offers a refreshing approach to banking. With its zero balance requirement, high-interest rates, and instant account opening, it’s a convenient and user-friendly choice. Whether you’re a student, a young professional, or simply someone who values the ease of digital banking, Kotak 811 has a lot to offer. So, why not take the leap and experience the future of banking today? Open your Kotak 811 Savings Account and unlock a world of financial possibilities.

TagsBankingCopy URL URL Copied

Send an email 10/09/20230 89 2 minutes read

Share

Facebook X LinkedIn Tumblr Pinterest Pocket Skype Messenger Messenger ViberShare

Facebook X LinkedIn Tumblr Pinterest Reddit VKontakte Odnoklassniki Pocket Skype Share via Email Print