PayNearby Retail Agent Reviews: Challenges and Opportunities for Improvement - Digiforum Space

Share

Facebook X LinkedIn Tumblr Pinterest Pocket Skype Messenger Messenger Viber

Paynearby Customer Reviews and Solutions

Paynearby Customer Review: PayNearby is a mobile app that aims to streamline financial transactions and services, making it a valuable tool for retail agents. However, recent reviews from PayNearby retail agents shed light on several issues and concerns they’ve encountered while using the app. In this article, we will analyze these reviews (All reviews taken from Play Store : Sept-2023) and explore how PayNearby can improve its services to better serve its retail agent community.

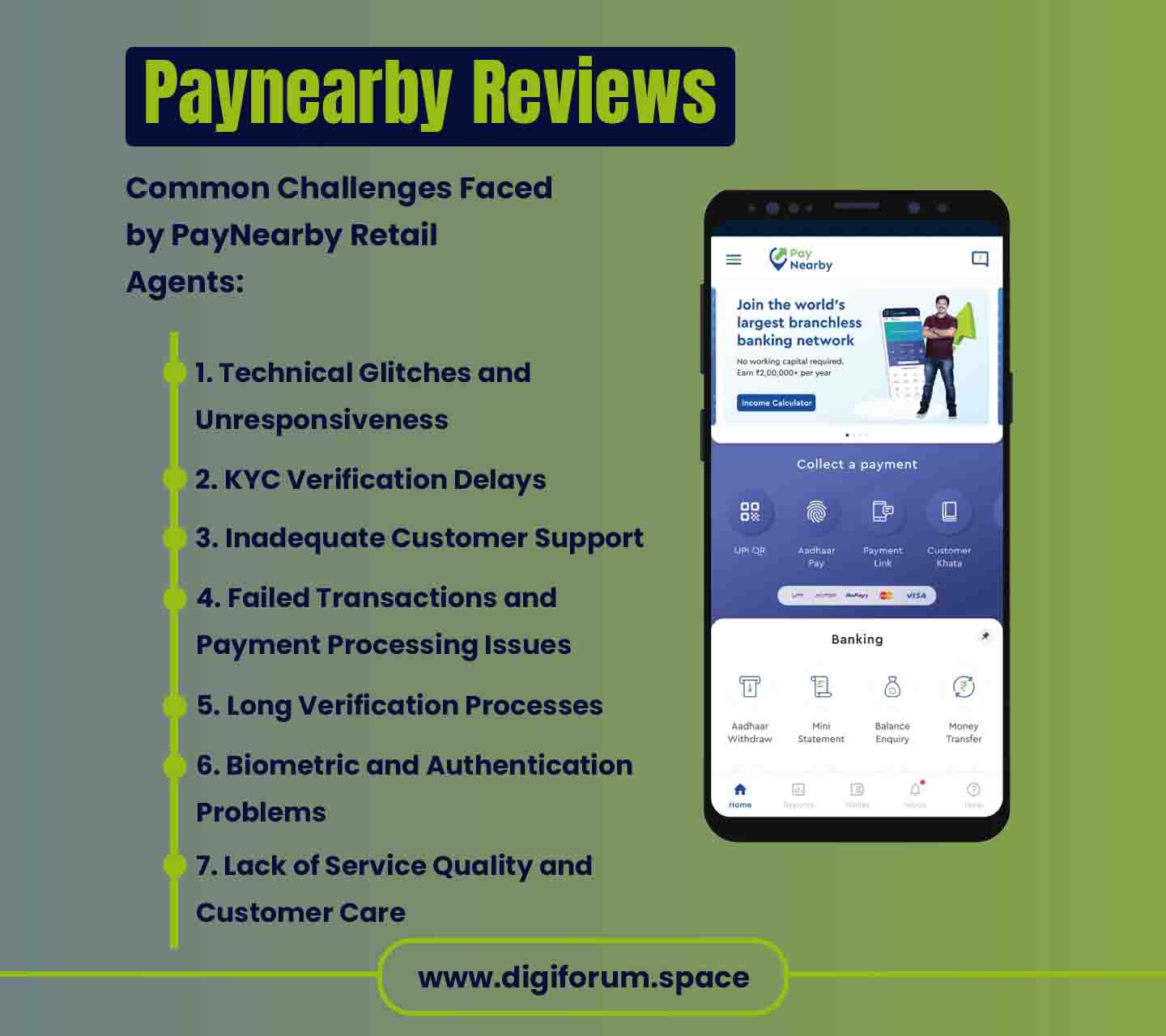

1. Common Challenges Faced by PayNearby Retail Agents – Paynearby Customer Review

a) Technical Glitches and Unresponsiveness:

- Wasim Raza and Mukesh Kumar Baski expressed frustration over the technical glitches they faced, including app malfunctions and account blockages. They also highlighted the lack of responsiveness from PayNearby’s customer care.

- Vinay Rathiya and Seenu shravan reported slow location fetching, which can cause significant delays in transactions, impacting the efficiency of retail agents’ services.

b) KYC Verification Delays:

- Kurrey Consultancy Services and Kedar Rana shared concerns about extended delays in PayNearby wallet and eDistrict ID mapping. They questioned the efficiency of the collaboration with state governments, suggesting that other vendors may handle these tasks more effectively.

c) Inadequate Customer Support:

- Several users, including Nagesh kumar, Sahil Udhpal, and RAJU KUMAR, complained about the unavailability and lack of response from PayNearby’s customer care. This can leave retail agents feeling unsupported when dealing with critical issues.

d) Failed Transactions and Payment Processing Issues:

- Users like Atanu Langal and Sohail mirza reported failed bank account linkage attempts and difficulties transferring wallet funds to their banks. Such issues can lead to financial losses and diminish trust in the app.

e) Long Verification Processes:

- Kedar Rana mentioned the lengthy KYC verification process, which significantly delayed his access to the app’s full functionality. Delays in verification can be particularly frustrating for new users eager to start using the platform.

f) Biometric and Authentication Problems:

- Ks Matharoo and Shivaranjan B R faced issues with biometric authentication and password resets, hampering their ability to perform transactions smoothly.

g) Lack of Service Quality and Customer Care:

- Users like SZA Inventions, Lucky Begum, and Syed Aleemuddin expressed dissatisfaction with PayNearby’s overall service quality and customer care. They felt that the app did not live up to their expectations and that customer care was unresponsive to their concerns.

Related Articles

- Care Health Insurance Reviews

- Navi Loan App: Separating Fact from Fiction – Is it Fake or Real?

- How to Become a Jio Retailer?

- AEPS Cash Withdrawal Message

- Online PAN Verification by PAN Number

2. How Can PayNearby Improve Its App and Services?

a) Prioritizing Technical Stability

One key area of focus for PayNearby’s ongoing improvement efforts should undoubtedly be the enhancement of technical stability. This entails the prompt identification and resolution of technical glitches that may potentially disrupt the user experience. Ensuring that the app operates seamlessly is paramount, as it not only prevents account blockages but also minimizes the occurrence of transaction-related issues, contributing to a smoother, trouble-free experience for all users.

b) Streamlining the Customer Experience

Apart from technical aspects, PayNearby can significantly boost user satisfaction by refining and streamlining the overall customer experience. This includes making it easier for customers to navigate through the app, find the information they need, and complete transactions swiftly. Intuitive design and user-friendly interfaces can be pivotal in achieving this goal.

c) Enhancing Security Measures

Security is a paramount concern in any financial app, and PayNearby should be committed to continually enhancing security measures. Implementing robust security protocols and keeping users informed about the steps taken to protect their data can instill confidence in the app’s reliability.

d) Expanding Service Offerings

To attract and retain users, PayNearby can explore the expansion of its service offerings. This could include introducing new financial products, payment options, or even educational resources to empower users with financial literacy. A comprehensive and diversified range of services can cater to a broader user base.

e) Feedback and Communication

Open channels for user feedback and effective communication can be integral to improvement. PayNearby can create mechanisms for users to report issues, provide suggestions, and receive updates on the company’s efforts to address their concerns. This transparent approach not only keeps users in the loop but also demonstrates the company’s commitment to their needs.

f) Continuous Learning and Adaptation

The digital landscape is ever-evolving, and PayNearby should be adaptable and open to continuous learning. Staying updated with the latest industry trends and technologies is essential for remaining competitive and providing users with cutting-edge services.

Incorporating these strategies will not only bolster PayNearby’s app and services but also contribute to a more robust and satisfying user experience, further solidifying the platform’s position in the digital financial landscape.

3)The Psychology Behind Negative Reviews: Understanding User Feedback

The article includes negative reviews from PayNearby retail agents, which may not necessarily represent the entire spectrum of user experiences. Several factors could explain why negative reviews are more prominent:

a) Bias in Reporting

It’s a well-documented phenomenon that users who’ve encountered negative experiences are often more motivated to express their sentiments through reviews. These reviews serve as a platform for them to vent their frustrations or seek much-needed assistance when facing challenges.

b) Frustration Amplifies Feedback

Factors such as technical glitches, delays in service, or unresponsiveness can significantly elevate frustration levels. This heightened frustration is often the catalyst behind users sharing their negative experiences more frequently, underlining the necessity for addressing these issues.

c) Lack of Alternatives and Investment

Some users, even in the face of recurring issues, continue using the app. This decision can be driven by a lack of viable alternatives or, in some cases, a significant investment of time and effort in the utilization of PayNearby. These are valuable insights to consider when improving the user experience.

d) Hopes for Solutions

Users who have encountered obstacles may turn to sharing their negative experiences with the hope of obtaining solutions or assistance. They see this as a potential avenue to engage with the company or the community and find resolutions to their concerns.

e) The Community Effect

The impact of negative reviews extends beyond individual experiences. Once a few negative reviews surface, they can significantly influence others to share their own negative experiences. This phenomenon creates a cascading effect, emphasizing the importance of addressing issues swiftly.

f) Communication through Reviews

Many users view the review platform as a direct channel to communicate their concerns with the company. They anticipate responses and resolutions, which can be pivotal in retaining customer trust and loyalty.

g) Human Nature at Play:

It’s worth noting that people often exhibit a tendency to share negative experiences more readily than positive ones. Negative encounters tend to leave a stronger emotional imprint, making them more likely to be vocalized. Understanding this aspect of human nature can guide strategies for managing user feedback effectively.

Note –

It’s important to note that negative reviews do not necessarily reflect the overall quality of a product or service. Many users may have positive experiences with PayNearby but may not leave reviews. To gain a more balanced understanding, it’s essential to consider both positive and negative feedback and recognize that individual experiences can vary widely.

FAQs – Frequntly Asked Questions and Answers

Q. Do negative reviews necessarily reflect the overall quality of PayNearby’s services?

Ans. Negative reviews do not necessarily reflect the overall quality of PayNearby’s services. Many users may have positive experiences but may not leave reviews. It’s essential to consider both positive and negative feedback to gain a balanced understanding of the app’s performance.

Q. What is PayNearby, and why are retail agents using it?

Ans. PayNearby is a mobile app designed to streamline financial transactions and services, making it a valuable tool for retail agents who offer various financial services through the app.

Q. Why do negative reviews seem more prominent, and what factors contribute to this phenomenon?

Ans. Negative reviews may appear more prominent due to factors such as a bias in reporting, increased frustration levels, the lack of viable alternatives, the hope for solutions, the community effect, communication through reviews, and the tendency of people to share negative experiences more readily.

Q. How can PayNearby improve its app and services to address these challenges?

Ans. PayNearby can enhance its app and services by prioritizing technical stability, streamlining the customer experience, enhancing security measures, expanding its service offerings, encouraging feedback and communication, and embracing continuous learning and adaptation.

Q. What are some common challenges faced by PayNearby retail agents according to customer reviews?

Ans. PayNearby retail agents have reported challenges such as technical glitches, KYC verification delays, inadequate customer support, failed transactions, long verification processes, biometric and authentication problems, and a perceived lack of service quality and customer care.

Conclusion

PayNearby retail agents have voiced their feedback, shedding light on a diverse range of challenges that the app and its services currently grapple with. It is evident that by diligently attending to these concerns and actively integrating the recommended enhancements, PayNearby stands poised to significantly elevate its platform. This, in turn, will enable the company to offer more robust support to its invaluable retail agent community. The ultimate result? A user experience that is not only more positive but also inherently more productive.

TagsPaynearby ReviewCopy URL URL Copied

Send an email 21/10/20230 97 5 minutes read

Share

Facebook X LinkedIn Tumblr Pinterest Pocket Skype Messenger Messenger ViberShare

Facebook X LinkedIn Tumblr Pinterest Reddit VKontakte Odnoklassniki Pocket Skype Share via Email Print