Finance

-

Second-Hand Bike Finance

In the age of environmental awareness and financial prudence, second-hand bikes are becoming increasingly popular. These cost-effective and eco-friendly modes of transportation not only help reduce your carbon footprint but also contribute to substantial savings. However, the initial cost of purchasing a second-hand bike can still be a significant financial burden for many. This is where second-hand bike finance comes…

Read More » -

Instant Loan App Without Credit Score

How to Secure an Instant Loan Without a Credit Score – A Hassle-Free Approach A high Credit score is often seen as the golden ticket to accessing instant loans. However, life doesn’t always adhere to the ideals of credit scores, and there are countless individuals who lack this coveted number. But here’s the good news – it is entirely possible…

Read More » -

RBI Approved Loan Apps in India

The Ultimate Guide to Choosing RBI Approved Loan Apps in India In a world brimming with fraudulent loan applications, the quest for a reputable lending app sanctioned by a regulatory authority can be a daunting one. If you find yourself on the hunt for the best RBI Approved Loan Apps in India, look no further. This comprehensive guide will provide…

Read More » -

PPC Online Advertising Service

The Power of PPC Online Advertising In the fast-paced digital landscape, where competition rages on, and the quest for consumer attention knows no respite, PPC (Pay-Per-Click) advertising emerges as a powerful ally. This section serves as the threshold for our expedition into the intricate and dynamic universe of PPC online advertising, where we delve into the strategies and nuances that…

Read More » -

Royal Sundaram Car Insurance Claim Settlement Ratio

Royal Sundaram’s Car Insurance Claim Settlement Ratio When it comes to car insurance, one of the critical factors that every car owner should consider is the claim settlement ratio of the insurance provider. The claim settlement ratio is an indicator of how efficiently an insurer processes and pays out claims. In this blog article, we will delve into the claim…

Read More » -

The Benefits of HDFC ERGO Zero Depreciation Car Insurance

If you’re a car owner, you’re well aware that over time, your vehicle’s value depreciates. This depreciation is a significant factor when it comes to car insurance claims. However, HDFC ERGO offers a solution to this problem in the form of zero depreciation car insurance. In this blog article, we’ll explore what HDFC ERGO zero depreciation car insurance is, how…

Read More » -

How to Contact Mobikwik Customer Care?

The Comprehensive Guide: How to Contact Mobikwik Customer Care In the fast-paced digital world, where financial transactions and digital payments are an integral part of our lives, it’s essential to have reliable customer support for the platforms and apps we use. Mobikwik, a popular digital wallet and financial services platform in India, is no exception. Whether you have questions, concerns,…

Read More » -

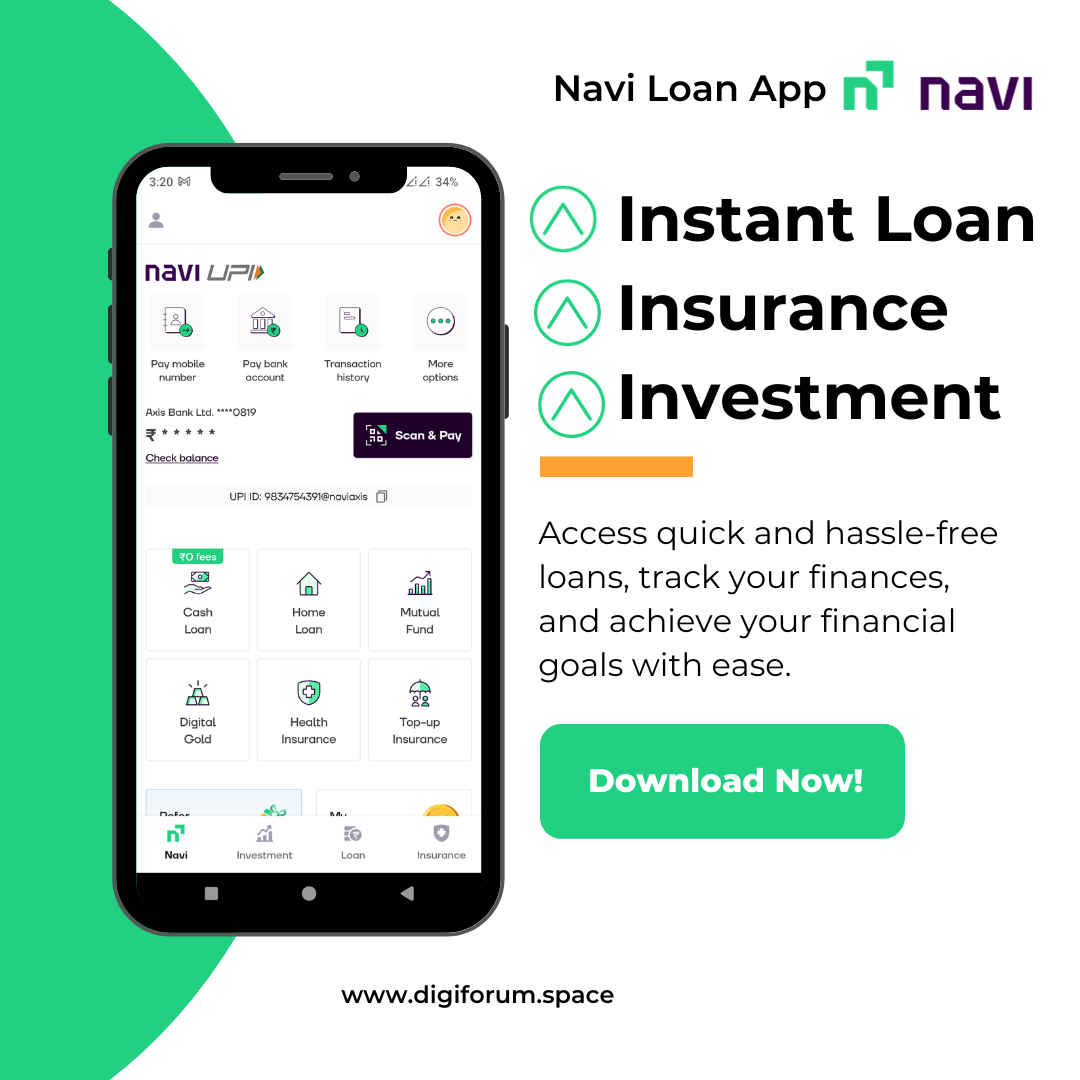

What is Navi Loan App?

What is Navi Loan App?: Your Gateway to Quick and Convenient Loans In a world where financial needs can arise unexpectedly, having access to quick and reliable loan options can be a game-changer. Navi, a prominent name in the fintech sector, offers a mobile loan app designed to provide individuals with easy access to personal loans. In this article, we’ll…

Read More » -

How to become a Financial Advisor in 2023

How to become a Financial Advisor in 2023 In a rapidly evolving financial landscape, the role of a financial advisor has never been more crucial. As we step into 2023, the world is witnessing a convergence of technological advancements, shifting regulations, and changing client expectations. To navigate this dynamic terrain and embark on a successful career as a financial advisor,…

Read More » -

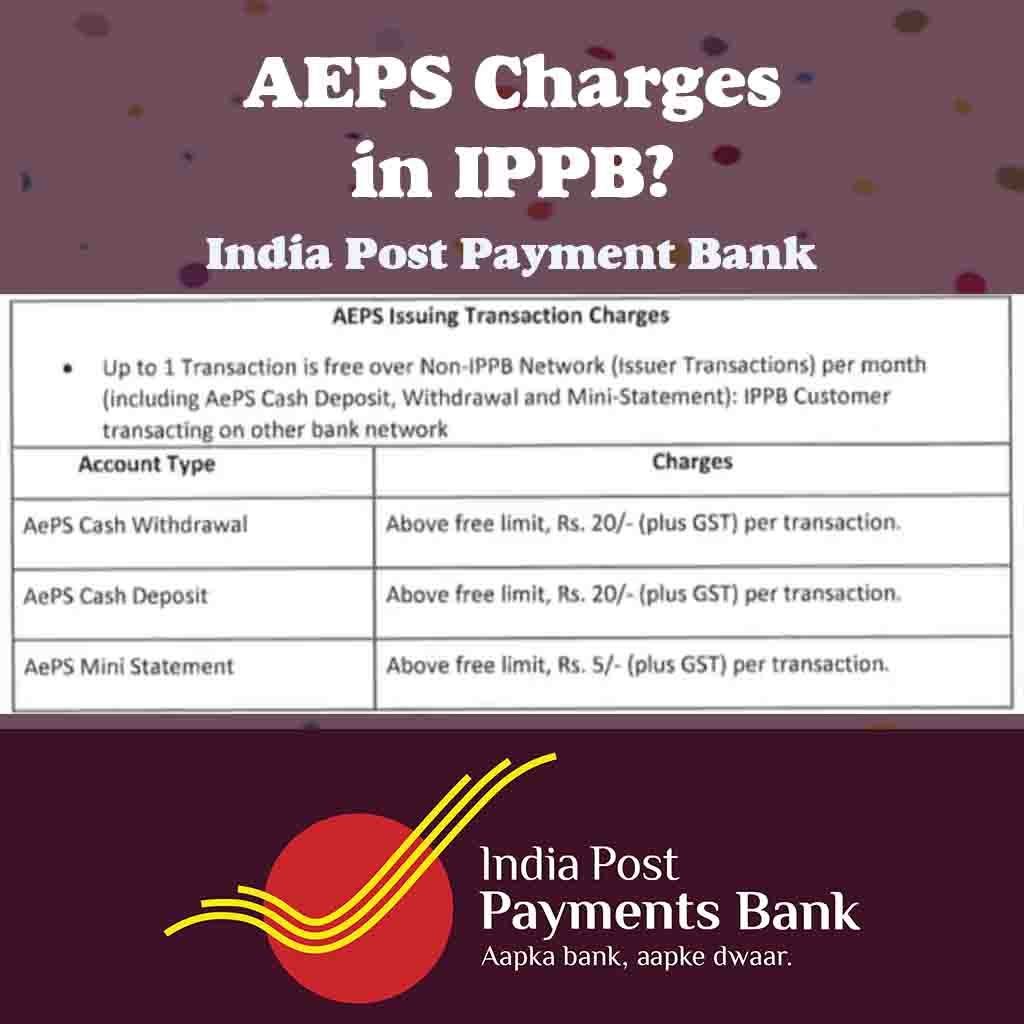

What are the AEPS Charges in IPPB?

What are the AEPS Charges in IPPB? The Aadhaar Enabled Payment System (AEPS) is an electronic payment system that allows customers to perform financial transactions using their Aadhaar number and biometric authentication. India Post Payments Bank (IPPB) is a government-owned payments bank that offers AEPS services to its customers. In this article, we will explore the AEPS charges levied by…

Read More »