Banking And Finance

-

Payment Not Initiated for the Beneficiary: A Closer Look

Payment Not Initiated for the Beneficiary: A Closer Look In today’s digital age, the efficiency and reliability of payment systems are crucial for businesses, individuals, and financial institutions. Unfortunately, issues can arise, such as payments not being initiated for the intended beneficiary. This article explores the common causes, consequences, and solutions when payments are not initiated as expected, shedding light…

Read More » -

Auto Sweep Facility in Banks: Maximizing Returns on Idle Funds

Auto Sweep Facility in Banks: Maximizing Returns on Idle Funds In today’s fast-paced world, managing finances efficiently is of utmost importance. One financial tool that has gained prominence over the years is the “Auto Sweep Facility” offered by banks. This innovative feature allows individuals to earn higher interest on their idle funds while maintaining liquidity. In this comprehensive article, we…

Read More » -

How does Recurring Deposit Works?

Understanding How Recurring Deposits Work How does Recurring Deposit Works?: Recurring deposits are a reliable and popular investment option for individuals looking to cultivate a disciplined savings habit while earning a competitive interest rate. In this comprehensive guide, we will delve into the mechanics of recurring deposits, shedding light on the various aspects that make them an attractive financial instrument.…

Read More » -

How to close Airtel Payment Bank Account?

How to Close/Delete/Deactivate Airtel Payments Bank Account? How to Close/Delete/Deactivate Airtel Payments Bank Account?: Airtel Payments Bank is India’s pioneering digital bank, offering a wide range of financial services to its customers. However, there might be instances where you find it necessary to close your Airtel Payments Bank account. Whether it’s due to having multiple bank accounts, dissatisfaction with services,…

Read More » -

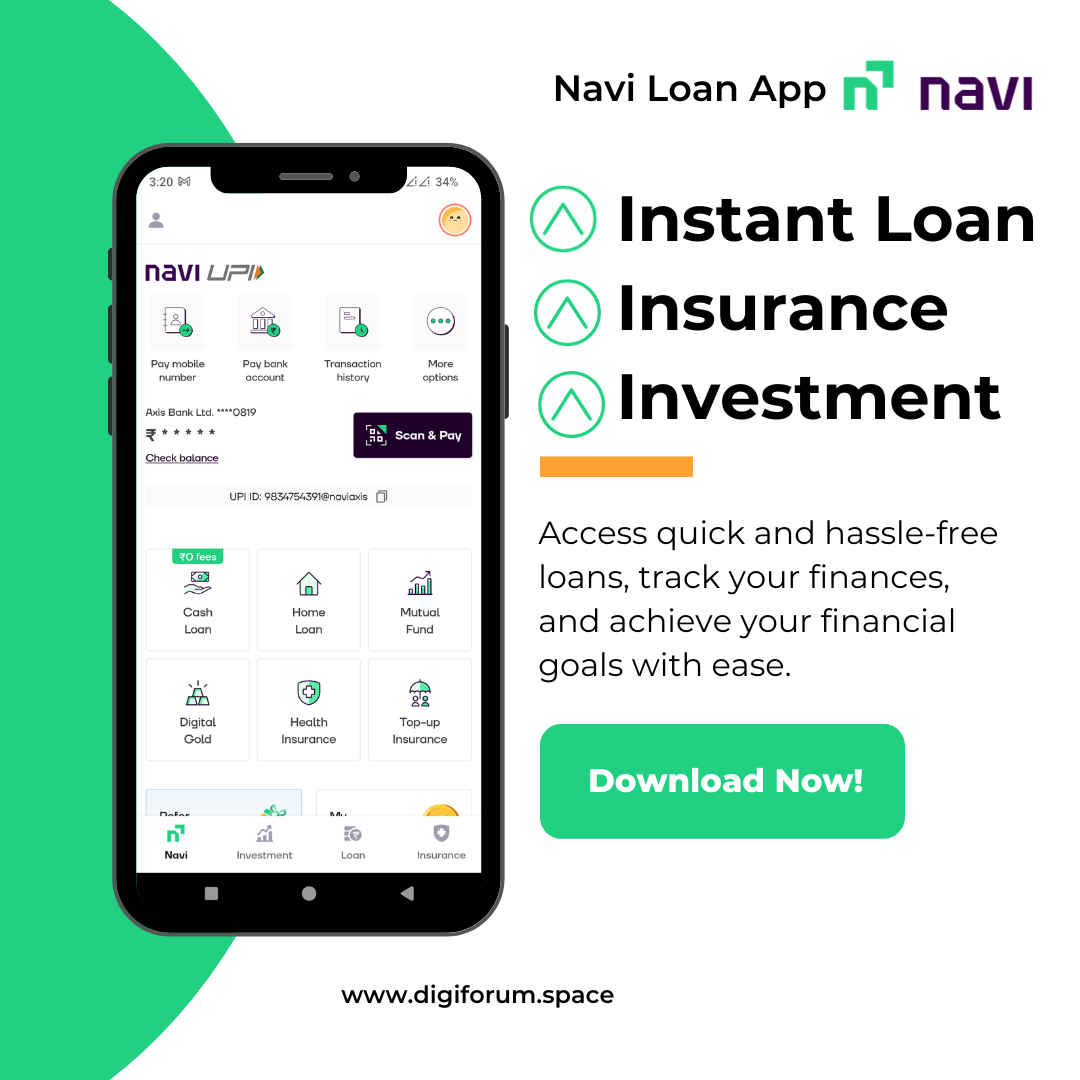

What is Navi Loan App?

What is Navi Loan App?: Your Gateway to Quick and Convenient Loans In a world where financial needs can arise unexpectedly, having access to quick and reliable loan options can be a game-changer. Navi, a prominent name in the fintech sector, offers a mobile loan app designed to provide individuals with easy access to personal loans. In this article, we’ll…

Read More » -

Benefits of Content Marketing in Financial Services

Transforming the Financial Landscape: Content Marketing in Financial Services with NSK Multiservices In the ever-evolving world of finance, establishing trust, educating clients, and staying ahead of the competition are paramount. Content marketing has emerged as a powerful tool for financial services providers to achieve these objectives. NSK Multiservices, a leader in digital marketing, is at the forefront of this transformation.…

Read More » -

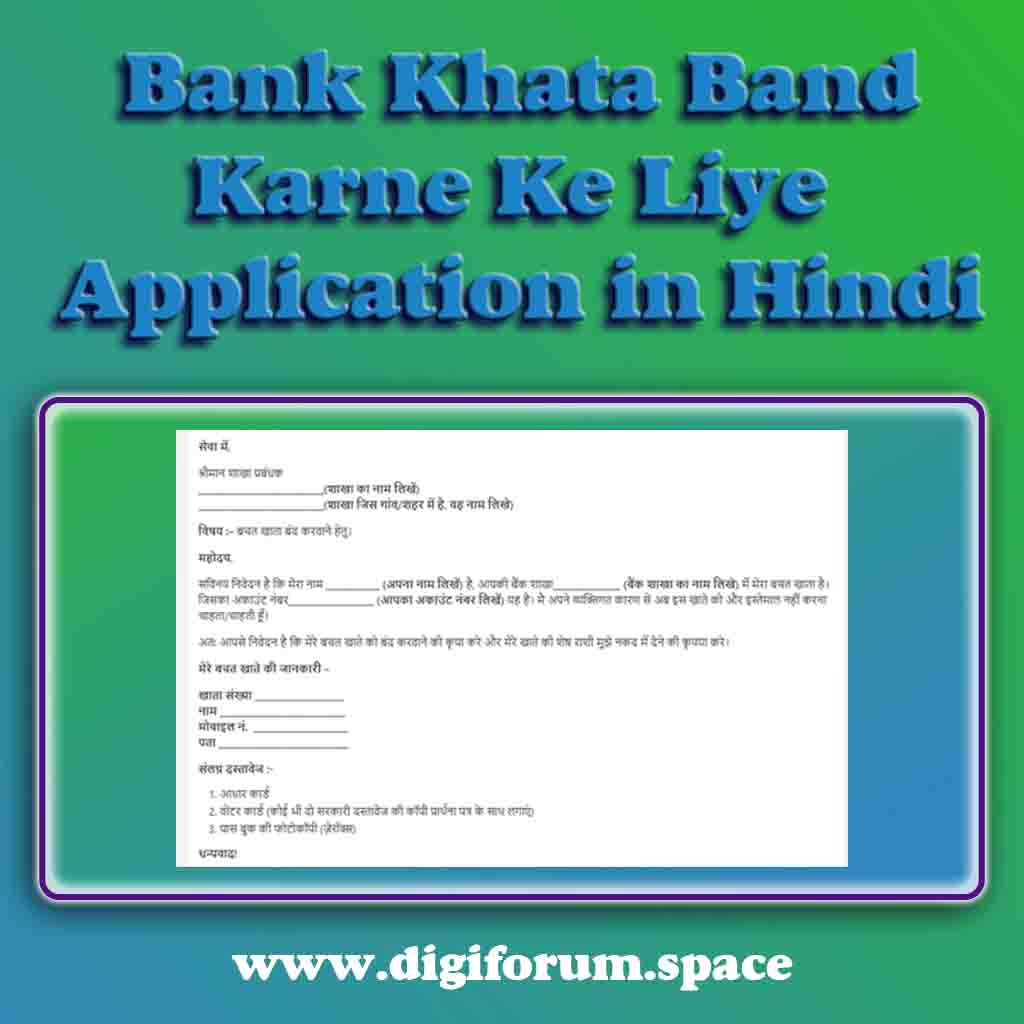

Bank Khata Band Karne Ke Liye Application in Hindi

Bank Khata Band Karne Ke Liye Application in Hindi | खाता बंद करने के लिए एप्लीकेशन पीडीऍफ़ Bank Khata Band Karne Ke Liye Application in Hindi : दोस्तों आज हमने बैंक खाता बंद करवाने का एप्लीकेशन लिखी है। कई बार लोगों को अपना बैंक खाता बंद करवाना होता है यह कई कारणों से हो सकता है। या तो उनके पास अन्य बैंक में…

Read More » -

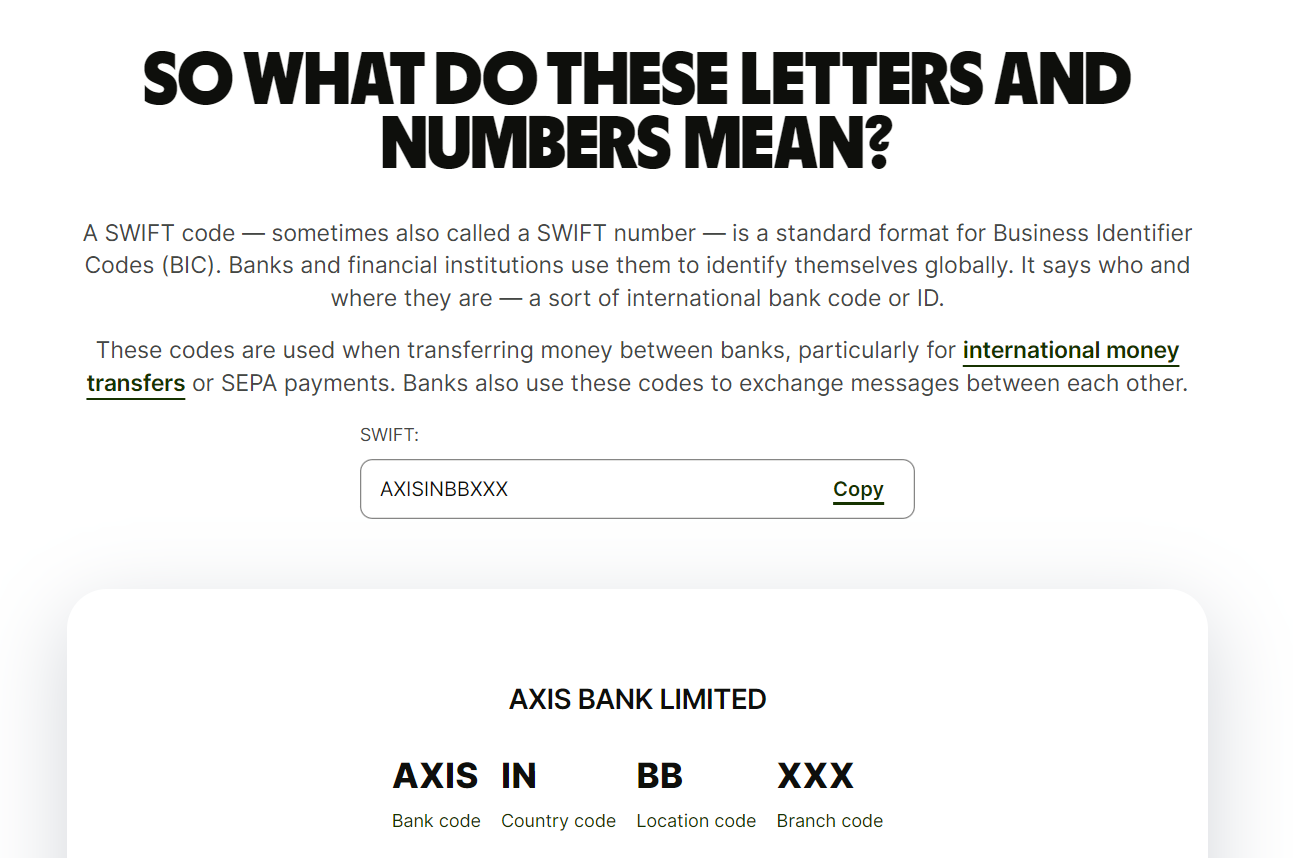

How Can I Get My Axis Bank SWIFT Code?

How Can I Get My Axis Bank SWIFT Code? When it comes to international financial transactions, having the correct SWIFT (Society for Worldwide Interbank Financial Telecommunication) code is crucial. The SWIFT code ensures that your funds reach the intended bank and branch securely. If you’re a customer of Axis Bank and need to find your SWIFT code, you’re in the…

Read More » -

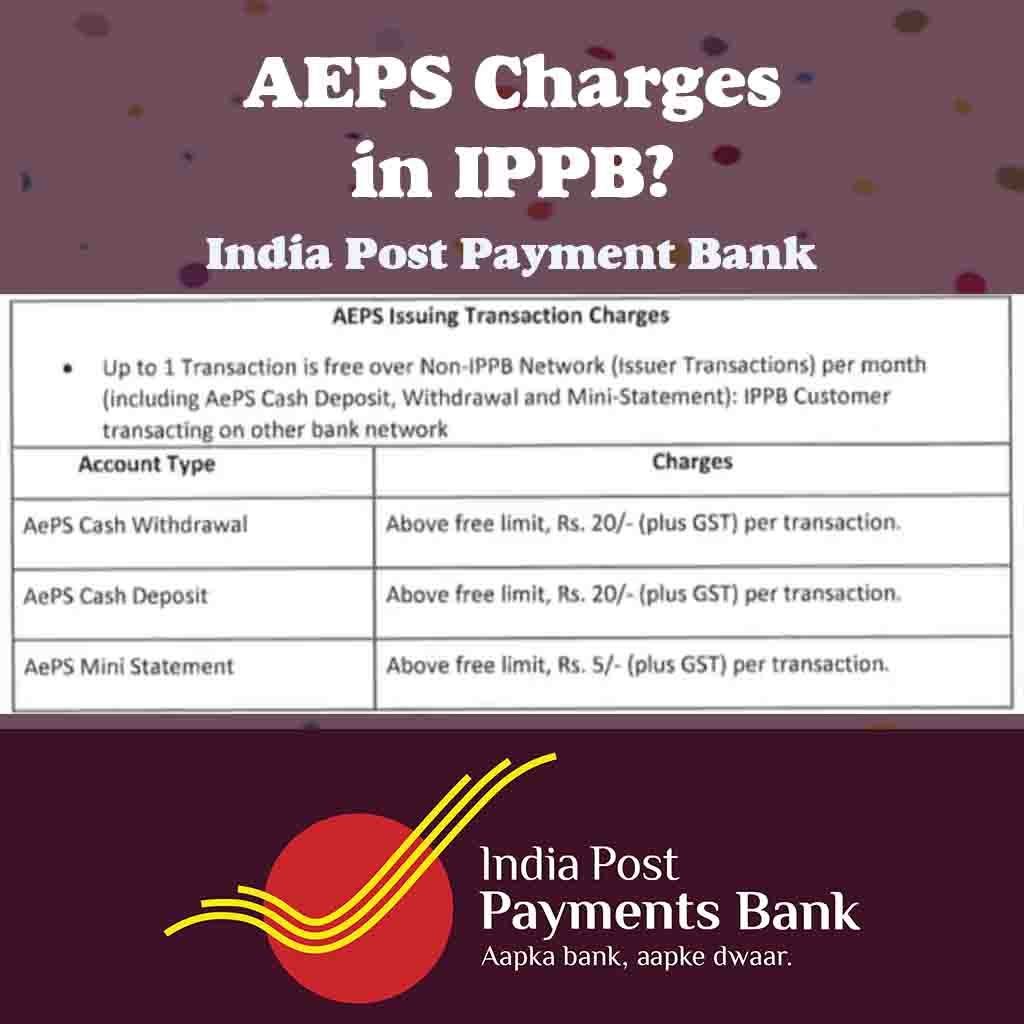

What are the AEPS Charges in IPPB?

What are the AEPS Charges in IPPB? The Aadhaar Enabled Payment System (AEPS) is an electronic payment system that allows customers to perform financial transactions using their Aadhaar number and biometric authentication. India Post Payments Bank (IPPB) is a government-owned payments bank that offers AEPS services to its customers. In this article, we will explore the AEPS charges levied by…

Read More » -

How to save money fast in piggy bank: 10 Proven Strategies

10 Proven Strategies to Fill Your Piggy Bank Quickly and Secure Your Financial Future Saving money is a financial habit that can pave the way for a secure future. One of the simplest yet effective ways to start saving is by using a piggy bank. In this article, we will explore ten proven strategies to help you save money fast…

Read More »