How Can I Get My Axis Bank SWIFT Code?

When it comes to international financial transactions, having the correct SWIFT (Society for Worldwide Interbank Financial Telecommunication) code is crucial. The SWIFT code ensures that your funds reach the intended bank and branch securely. If you’re a customer of Axis Bank and need to find your SWIFT code, you’re in the right place. In this blog post, we’ll guide you through the process of obtaining your Axis Bank SWIFT code, explain what it is, and why it’s essential.

What is SWIFT Code of axis bank?

A SWIFT code, also known as a Bank Identifier Code (BIC), is a unique alphanumeric code used to identify a specific bank and branch during international transactions. It plays a crucial role in ensuring the seamless and secure transfer of funds across borders. Every bank, including Axis Bank, has its unique SWIFT code that identifies its location and branch.

Why Do You Need Your Axis Bank SWIFT Code?

- International Wire Transfers: If you’re sending or receiving money from abroad, the SWIFT code is essential. It tells the sending bank where to send the funds and ensures they reach the correct destination.

- Correspondent Banking: SWIFT codes are used in correspondent banking relationships, where banks have accounts with each other to facilitate cross-border transactions.

- International Payments: For online payments or purchases from international merchants, your Axis Bank SWIFT code may be required to verify your bank account.

Wise – Sponsered

Hey there!

If you’re looking for a smart and cost-effective way to send money internationally, We highly recommend using Wise. We’ve been using their services for a while now, and it’s been a game-changer for us when it comes to transferring money abroad.

The best part? When you sign up using my referral link or code https://wise.com/invite/dic/a1af1b, you’ll get an exclusive discount of Rs. 25,000 on transfer charges! It’s a fantastic deal that’ll save you money right from the start.

Why choose Wise?

- Low and transparent fees

- Real exchange rate, no hidden markups

- Fast and reliable transfers

- Multi-currency account for international transactions

- Trusted by millions of customers worldwide

So, whether you need to send money to family and friends, pay for international services, or manage your finances globally, Wise is the way to go.

Here’s how to get your discount:

- Click on our referral link: https://wise.com/invite/dic/a1af1b

- Sign up for a free Wise account.

- Make your first transfer and enjoy a Rs. 25,000 discount on transfer charges!

Don’t miss out on this fantastic opportunity to save on international money transfers. Give Wise a try, and experience a hassle-free way to send money across borders.

If you have any questions or need assistance, feel free to reach out. Happy transferring!

How to Find Your Axis Bank SWIFT Code

Finding your Axis Bank SWIFT code is a straightforward process. Here are the steps:

- Check Your Bank Statement: Your SWIFT code is often listed on your bank statement. It’s a good place to start your search.

- Visit the Axis Bank Website: Go to the official Axis Bank website (www.axisbank.com).

- Contact Customer Support: If you can’t find the SWIFT code on your statement or the website, the most reliable option is to contact Axis Bank’s customer support. They will provide you with the correct SWIFT code for your branch.

- Visit Your Local Branch: If you prefer an in-person approach, you can visit your local Axis Bank branch and ask a bank representative for the SWIFT code.

Update

Axis bank SWIFT Code

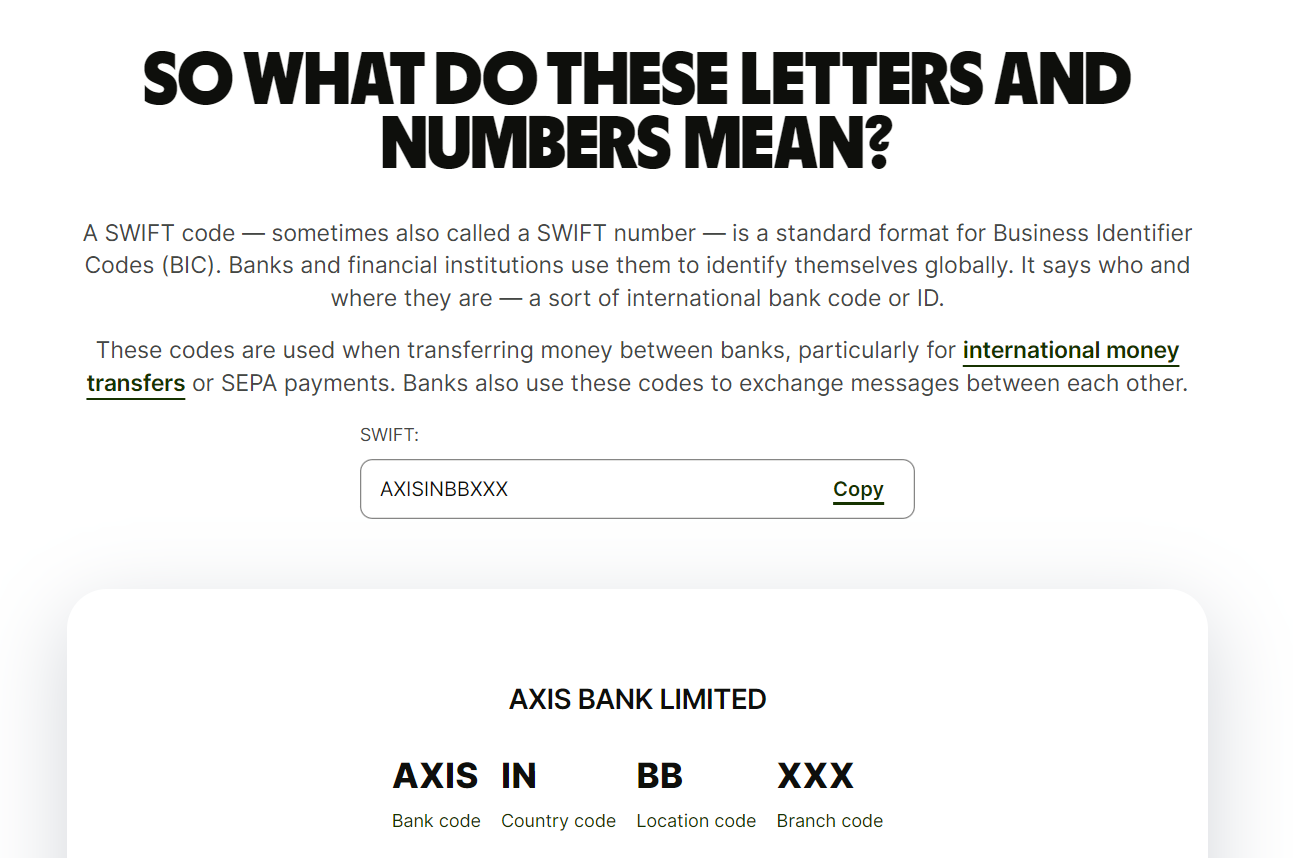

Use SWIFT Code “AXISINBBXXX” to transfer money to Axis bank Customer anywhere in India. SWIFT codes are used for international financial transactions to identify specific banks and branches. Here’s a breakdown of the components of “AXISINBBXXX”:

- AXIS: This part of the code represents the bank’s name or the bank identifier. In this case, “AXIS” stands for Axis Bank.

- IN: This two-letter code represents the country where the bank is located. In this case, “IN” stands for India.

- BB: The next two letters, “BB,” specify the city or location of the bank branch. In this example, “BB” typically refers to the bank’s headquarters or main office in Mumbai, India.

- XXX: The last three letters, “XXX,” are optional and can be used to provide additional information about the branch. In some cases, “XXX” is used to represent the main office or head office of the bank.

Additional Tips:

- Double-Check for Accuracy: When using your Axis Bank SWIFT code, ensure that it’s accurate. Even a small mistake in the code can lead to delays or failed transactions.

- Keep It Secure: Treat your SWIFT code with the same level of security as your bank account number. Don’t share it with anyone you don’t trust, and be cautious when providing it for online transactions.

- Stay Informed: SWIFT codes can change, so it’s a good practice to verify the code with the bank or their official website whenever you’re making an international transaction.

Related Articles

Conclusion

Getting your Axis Bank SWIFT code is a straightforward process, and it’s essential for any international financial activity. Whether you’re receiving funds from abroad or making international payments, having the correct SWIFT code ensures your transactions are smooth and secure. If you ever have trouble finding your SWIFT code, don’t hesitate to reach out to Axis Bank’s customer support or visit your local branch for assistance.

FAQs – frequently Asked Questions

<strong>1. What is a SWIFT code for Axis Bank?</strong>

The SWIFT code for Axis Bank is “AXISINBBXXX.” It’s a unique alphanumeric code used to identify the bank and its branch for international financial transactions.

<strong>2. Why do I need Axis Bank's SWIFT code?</strong>

You need the SWIFT code to facilitate international wire transfers, receive funds from abroad, and verify your bank account for international payments.

<strong>3. Can I use the same SWIFT code for all Axis Bank branches?</strong>

No, you cannot use the same SWIFT code for all branches. Each branch of Axis Bank may have a unique SWIFT code. It’s essential to use the specific SWIFT code for your branch or transaction.

<strong>4. How do I find the SWIFT code for my Axis Bank branch?</strong>

You can find your branch’s SWIFT code on your bank statement, by visiting Axis Bank’s official website, contacting customer support, or visiting your local branch.

<strong>5. Are there any charges for using Axis Bank's SWIFT code for international transactions?</strong>

Yes, there are typically charges associated with international wire transfers. These charges may vary depending on the type of transaction and the specific terms and conditions of your account.

<strong>6. Can I use the SWIFT code for online transactions with international merchants?</strong>

Yes, some international merchants may require your Axis Bank SWIFT code to verify your bank account when making online payments or purchases.

<strong>7. Is "AXISINBBXXX" the same SWIFT code for all Axis Bank branches in India?</strong>

No, while “AXISINBBXXX” is the SWIFT code for Axis Bank as a whole, specific branches may have different SWIFT codes. Always use the SWIFT code provided by your branch or on your bank statement.

<strong>8. What happens if I use the wrong SWIFT code for an international transaction?</strong>

Using the wrong SWIFT code can result in delays or failed transactions. It’s crucial to ensure the accuracy of the code to prevent any issues.

<strong>9. Can I change my Axis Bank branch's SWIFT code?</strong>

SWIFT codes are typically assigned to specific branches and locations and are not easily changed. If there’s a change in the SWIFT code for your branch, Axis Bank will inform you.

<strong>10. Is the SWIFT code the same as the IFSC code for Axis Bank?</strong>

No, the SWIFT code (or BIC) is used for international transactions, whereas the IFSC (Indian Financial System Code) is used for domestic transactions within India. They serve different purposes and formats.