Bank Account Insurance in India - Digiforum Space

Share

Facebook X LinkedIn Tumblr Pinterest Pocket Skype Messenger Messenger Viber

Bank Account Insurance in India

In today’s rapidly evolving world, safeguarding your financial assets has become more crucial than ever. One important aspect of protecting your money is bank account insurance. While many individuals in India are familiar with insurance policies for health, life, and property, bank account insurance is a relatively lesser-known concept. In this article, we will delve into the details of bank account insurance in India, its benefits, and how it can provide an added layer of security for your hard-earned money.

What is Bank Account Insurance?

Bank account insurance, also known as deposit insurance, is a form of protection offered by the Deposit Insurance and Credit Guarantee Corporation (DICGC), a subsidiary of the Reserve Bank of India (RBI). It provides insurance coverage for deposits held by individuals in banks in case of bank failure or liquidation. In simpler terms, it means that if your bank goes bankrupt, you will be reimbursed up to a certain amount for the funds held in your account.

Related Articles

- Bank के पास आपका PAN Data नहीं होने पर भी क्या आप TDS Credit Claim कर पाएंगे?

- Personal Accidental Insurance by Religare – Paynearby

- How to claim refund of 500 rupees against branding in Diamond Pack

- Fixed deposit double in 5 Years

- Types of Insurance Policies – in Hindi

Coverage and Limits

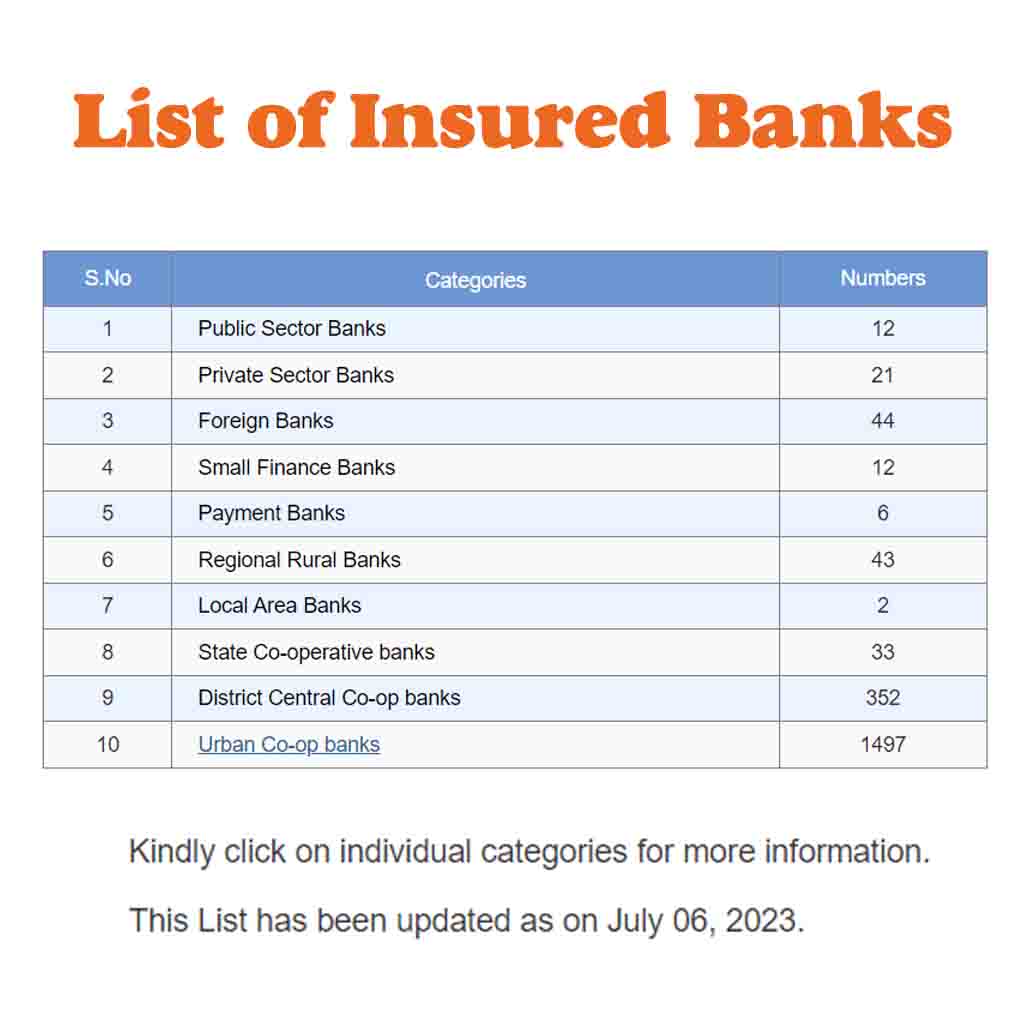

As per the guidelines laid down by the DICGC, all banks operating in India that are insured by the corporation offer bank account insurance to their customers. Under the current provisions, each depositor is insured up to a maximum of Rs. 5 lakh (rupees five lakh) per bank, including both principal and interest amounts. It’s important to note that this coverage limit applies to the sum total of all deposits held by an individual in the same bank, irrespective of the number of accounts.

Eligibility and Types of Accounts Covered

Almost all types of bank accounts are covered under the bank account insurance scheme in India. This includes savings accounts, current accounts, fixed deposits, recurring deposits, and any other type of deposit account held with a bank that is insured by the DICGC. Whether you are an individual, a joint account holder, or even a minor, as long as you hold a deposit in a covered bank, you are eligible for the insurance coverage.

Bank Failure and Claim Process

In the unfortunate event of a bank failure, the DICGC steps in to safeguard depositors’ interests. The process begins with the RBI placing the bank under a moratorium, which temporarily restricts withdrawals and other financial transactions. During this period, the DICGC starts the claims settlement process. Depositors are required to file a claim application with the DICGC, either directly or through the liquidator appointed by the RBI. The DICGC then verifies the claim and disburses the insured amount to the eligible depositors.

Benefits of Bank Account Insurance

- Financial Protection: Bank account insurance provides peace of mind by offering financial protection against bank failures. It ensures that even if your bank faces financial difficulties, your deposits are safeguarded up to the specified limit.

- Easy and Accessible: The bank account insurance scheme is implemented across all banks in India, making it easily accessible to all depositors. There is no need to purchase separate insurance policies or pay additional premiums.

- Wide Coverage: The insurance coverage applies to various types of accounts, ensuring that different depositors, including individuals, families, and businesses, are protected.

- Government Backed: Bank account insurance is backed by the government of India, making it a reliable and trustworthy mechanism to safeguard your money. The DICGC is a statutory body established under the DICGC Act, 1961, which adds an extra layer of security.

Conclusion

Bank account insurance is a vital aspect of financial planning and security. It provides individuals, families, and businesses with protection against unforeseen events such as bank failures. By understanding the coverage limits, eligibility criteria, and the claim process, depositors in India can make informed decisions and secure their hard-earned money. While the chances of bank failures are rare, having bank account insurance ensures that you are prepared for any eventuality, providing you with peace of mind and financial stability. Remember, knowledge is power when it comes to protecting your finances.

Copy URL URL Copied

Send an email 09/09/20230 72 3 minutes read

Share

Facebook X LinkedIn Tumblr Pinterest Pocket Skype Messenger Messenger ViberShare

Facebook X LinkedIn Tumblr Pinterest Reddit VKontakte Odnoklassniki Pocket Skype Share via Email Print