Is Investing in Mobikwik Xtra Safe?

Investing in Mobikwik Xtra is safe or not? – Reviews : In digital finance, the rise of mobile wallets and online payment platforms has reshaped the way we manage our money and conduct transactions. Mobikwik Xtra, a prominent player in this field, offers users a unique opportunity not only to manage their funds but also to potentially invest and grow their wealth. However, as with any financial decision, the safety of investing in Mobikwik Xtra is a iportant consideration. In this article, we will deep dive into the various aspects of investing in Mobikwik Xtra to help you make an informed decision about its safety and viability.

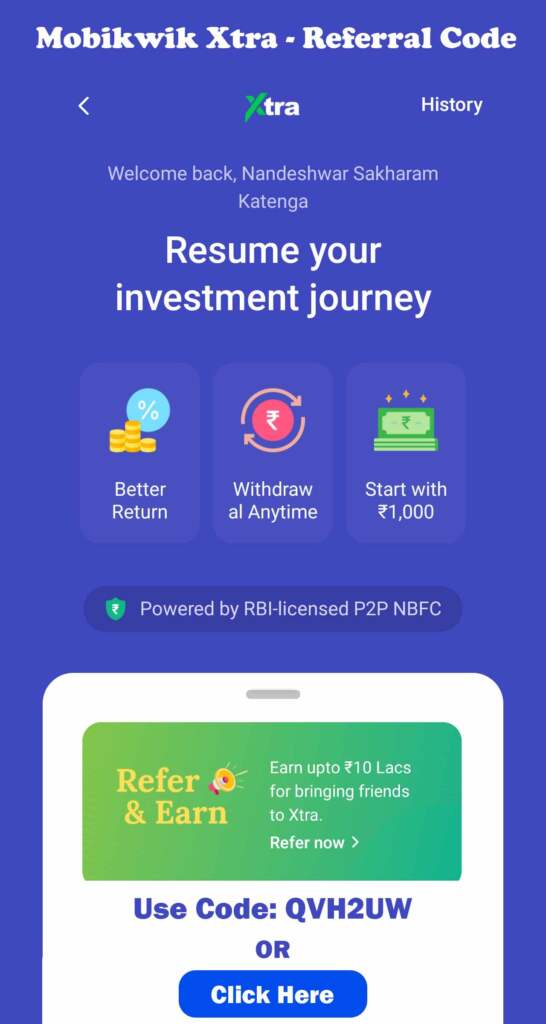

Mobikwik Xtra – P2P Lending Platform : Earn 12%

- Flexi plan: This plan offers interest up to 12% p.a. and no lock-in period. You can withdraw your investment at any time without any penalty.

- Plus plan: This plan offers interest up to 12.99% p.a. and a lock-in period of 3, 6, 9, or 12 months. If you withdraw your investment before the lock-in period, you may have to pay a penalty.

Referral Code : QVH2UW

1) What is Mobikwik Xtra?

Mobikwik Xtra is a peer-to-peer (P2P) lending platform that allows you to earn up to 12% p.a. by lending money to creditworthy borrowers. It is a product of Mobikwik, a popular digital wallet and payment app in India.

To invest in Mobikwik Xtra, you need to create an account on the Mobikwik app and complete the KYC process. Once your account is approved, you can start investing in Xtra. You can invest in Flexi or Plus plans.

- Flexi plan: This plan offers interest up to 12% p.a. and no lock-in period. You can withdraw your investment at any time without any penalty.

- Plus plan: This plan offers interest up to 12.99% p.a. and a lock-in period of 3, 6, 9, or 12 months. If you withdraw your investment before the lock-in period, you may have to pay a penalty.

The borrowers on Mobikwik Xtra are vetted by Lendbox, an RBI-regulated P2P lending platform. However, it is important to note that P2P lending is a relatively new investment product and there is no guarantee of returns. You should only invest in Mobikwik Xtra if you are comfortable with the risk.

a) Benefits of investing in Mobikwik Xtra:

- You can earn up to 12% p.a., which is higher than the returns offered by traditional investment options such as fixed deposits and savings accounts.

- You can invest in small amounts, starting from Rs. 1000. This makes it a good option for investors with limited funds.

- There is no lock-in period for the Flexi plan, so you can withdraw your investment at any time without any penalty.

- The borrowers on Mobikwik Xtra are vetted by Lendbox, which minimizes the risk of default.

b) Risks associated with investing in Mobikwik Xtra:

- P2P lending is a relatively new investment product and there is no guarantee of returns.

- The borrowers on Mobikwik Xtra may default on their loans, which could lead to losses for investors.

- The interest rates offered by Mobikwik Xtra are subject to change.

Related Articles

2) Investing in Mobikwik Xtra is safe or not?

Investing in Mobikwik Xtra is relatively safe, but there is no guarantee of returns. The platform is regulated by the RBI and the borrowers are vetted by Lendbox, which minimizes the risk of default. However, it is important to remember that P2P lending is a relatively new investment product and there is always the possibility of loss. Try to keep diversified your investment to balance the investment portfolio.

1. Here are some of the factors that make Mobikwik Xtra a relatively safe investment option:

- The platform is regulated by the RBI. This means that Mobikwik Xtra is subject to the same regulations as other financial institutions in India.

- The borrowers on Mobikwik Xtra are vetted by Lendbox. Lendbox is a leading P2P lending platform in India and has a strong track record of borrower repayment.

- There is no lock-in period for the Flexi plan. This means that you can withdraw your investment at any time without any penalty. This gives you the flexibility to exit the investment if you are not comfortable with the risk.

Overall, Mobikwik Xtra can be a good option for investors who are looking for higher returns and are willing to take on some risk. However, it is important to do your research before investing and to only invest money that you can afford to lose.

2. Here are some tips for safe investing in Mobikwik Xtra:

- Only invest money that you can afford to lose.

- Do your research before investing. This includes understanding the risks involved in P2P lending and the track record of Mobikwik Xtra and Lendbox.

- Start with a small investment. This will help you to learn the ropes and to mitigate your risk.

- Diversify your investments. This means investing in different P2P lending platforms and in different borrowers.

- Monitor your investments regularly. This will help you to identify any problems early on and to take action if necessary.

Start Earning 12%

Mobikwik Xtra : Download Now

How to Invest with Mobikwik Xtra

Here are the steps on how to invest with Mobikwik Xtra:

- Download the Mobikwik app from the Google Play Store or the Apple App Store.

- Create an account and complete the KYC process.

- Click on the “Xtra” tab on the home screen.

- Select the “Flexi” or “Plus” plan.

- Enter the amount you want to invest.

- Review the terms and conditions and click on “Invest”.

- Your investment will be processed and you will start earning interest.

Here are some additional details about the steps involved:

- To create an account, you will need to provide your name, email address, mobile number, and PAN card details. You will also need to take a selfie and a video selfie.

- The KYC process is required to verify your identity and address. You can do this by uploading your PAN card, Aadhaar card, and bank statement.

- The Flexi plan offers interest up to 12% p.a. and no lock-in period. You can withdraw your investment at any time without any penalty.

- The Plus plan offers interest up to 12.99% p.a. and a lock-in period of 3, 6, 9, or 12 months. If you withdraw your investment before the lock-in period, you may have to pay a penalty.

- The minimum investment amount for the Flexi plan is Rs. 1000. The minimum investment amount for the Plus plan is Rs. 5000.

- You can track your investments in the Mobikwik app. You will see the amount you have invested, the interest you have earned, and the maturity date of your investment.

Conclusion

Overall, Mobikwik Xtra can be a good option for investors who are looking for higher returns and are willing to take on some risk. However, it is important to do your research before investing and to only invest money that you can afford to lose.

Investing in Mobikwik Xtra can offer a convenient way to grow your wealth and dip your toes into the world of financial markets. The platform’s accessibility and low minimum investment options make it an attractive choice, especially for beginners. However, like all investments, Mobikwik Xtra Investments come with their own set of risks, including market volatility and potential fees.

To ensure the safety of your investments, it’s crucial to educate yourself, conduct thorough research, and consider your risk tolerance. While investing in Mobikwik Xtra can be a valuable addition to your financial journey, it’s important to approach it with a clear understanding of the pros and cons, as well as a commitment to ongoing monitoring and informed decision-making.