What is Lendbox? - Digiforum Space

Share

Facebook X LinkedIn Tumblr Pinterest Pocket Skype Messenger Messenger Viber

Empowering Borrowers and Investors: Exploring the World of Lendbox

In the ever-evolving landscape of financial technology, peer-to-peer (P2P) lending platforms have emerged as innovative solutions that bridge the gap between borrowers and investors. Lendbox is a prominent name in the P2P lending realm, offering a platform that connects individuals seeking loans with investors looking to diversify their portfolios. In this article, we will delve into the world of Lendbox, understanding its mission, features, benefits, and the role it plays in shaping the lending ecosystem.

What is Lendbox?

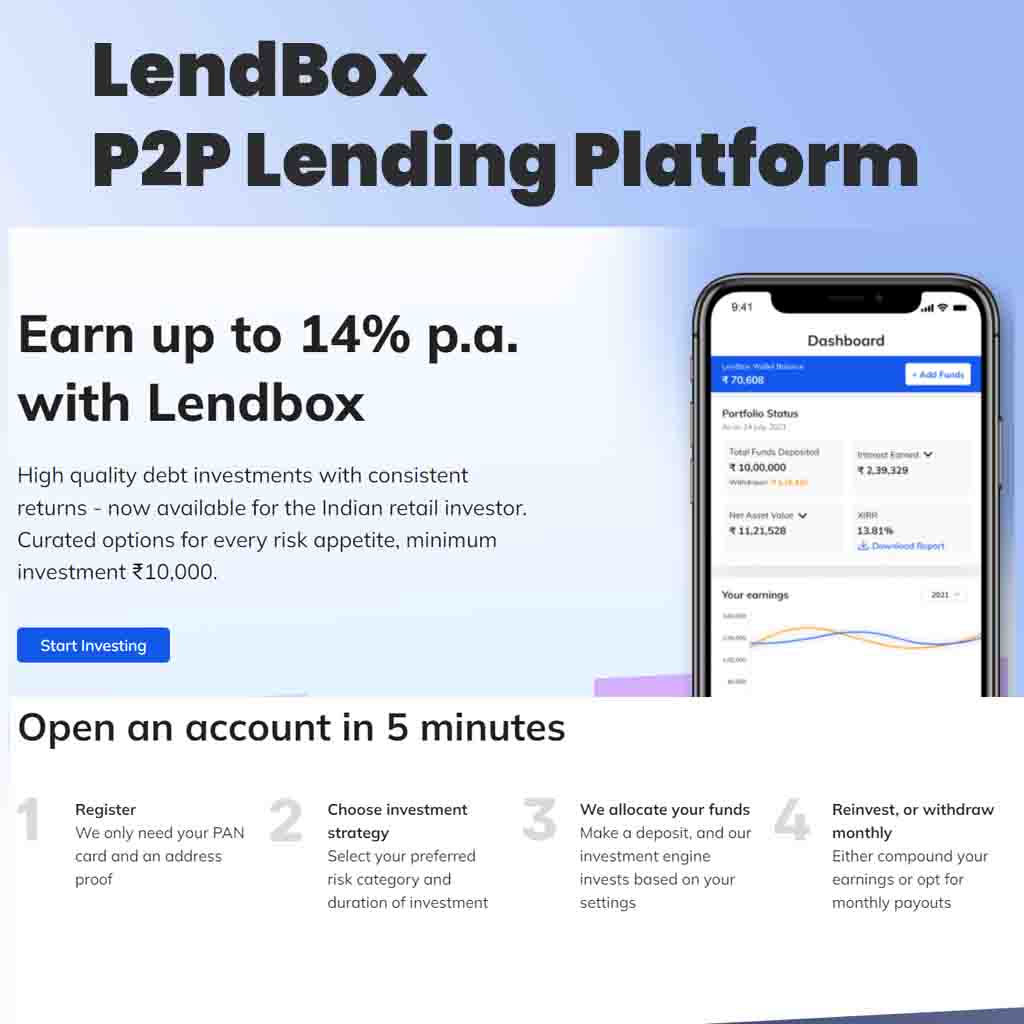

Lendbox is a P2P lending platform that facilitates lending transactions between borrowers and investors. The platform operates with the goal of making borrowing and lending more accessible, efficient, and transparent. Lendbox leverages technology to connect individuals seeking loans with investors willing to provide funds for those loans. This model cuts out traditional financial intermediaries and offers a win-win scenario for both borrowers and investors.

Related Articles

- Investing in Mobikwik Xtra is safe or not? – Reviews

- What is P2P Lending India?

- Online Instant Cash Loans Apps

- IDCW full form in mutual fund?

- Mobikwik Xtra Referral Code

How Lendbox Works?

- Borrower Application: Individuals in need of loans apply for funds on the Lendbox platform. They provide personal and financial information, which is then used to assess their creditworthiness.

- Loan Listings: Once a borrower’s application is approved, their loan request is listed on the platform. These listings include details about the borrower, the loan amount, interest rate, and the purpose of the loan.

- Investor wp-signup.php: Investors interested in lending their funds register on the Lendbox platform. They can browse through various loan listings and choose the loans they want to fund based on risk assessment.

- Investment Selection: Investors can select multiple loans to fund, thereby diversifying their investment and spreading the risk.

- Loan Disbursement: When the required funds are raised from multiple investors, the loan is disbursed to the borrower. The borrower then repays the loan in regular installments, which include both the principal and interest.

- Repayment and Returns: As borrowers repay their loans, investors receive their principal amount along with the interest earned. Lendbox typically manages the repayment process, ensuring timely collection and distribution.

Key Features and Benefits of Lendbox

- Access to Credit: Lendbox opens up borrowing opportunities for individuals who might not meet the stringent criteria of traditional banks. This is especially beneficial for those without a well-established credit history.

- Diversification for Investors: Investors can diversify their portfolios by lending to multiple borrowers. This spreads the risk and reduces the impact of default by a single borrower.

- Efficiency and Convenience: Lendbox streamlines the lending process by offering an online platform that facilitates communication between borrowers and investors. This convenience attracts tech-savvy users looking for seamless financial solutions.

- Competitive Interest Rates: Borrowers on Lendbox might find competitive interest rates compared to traditional lending options. This can translate to cost savings over the loan tenure.

- Transparency: Lendbox provides transparency by sharing detailed information about borrowers and the loans. This empowers investors to make informed lending decisions.

- Ease of Use: The platform’s user-friendly interface ensures that both borrowers and investors can navigate the platform with ease, making the lending process accessible to a wide audience.

- Regulatory Compliance: Lendbox operates under regulatory guidelines set by the Reserve Bank of India (RBI) for P2P lending platforms. This provides a sense of legitimacy and security for users.

The Role of Lendbox in Financial Inclusion

Financial inclusion, which involves ensuring that all individuals have access to affordable and appropriate financial products and services, is a critical objective in today’s world. Lendbox plays a role in promoting financial inclusion through various ways:

- Serving the Unbanked and Underbanked: Lendbox provides an alternative source of credit for individuals who might not have access to traditional banking services. This includes those with limited credit history or those residing in underserved areas.

- Flexible Eligibility Criteria: Lendbox’s approach to assessing borrowers’ creditworthiness is often more flexible than traditional lenders. This accommodates a broader range of borrowers who might not meet stringent bank criteria.

- Customized Loan Options: Lendbox’s platform allows borrowers to outline their loan requirements and purposes. This flexibility caters to the diverse needs of borrowers, including those who require specialized loans for education, healthcare, or small businesses.

- Investment Opportunities for Individuals: Lendbox provides individuals with the chance to invest their funds in a way that aligns with their financial goals. This inclusivity extends to investors who seek alternatives beyond traditional investment vehicles.

Note –

As the financial landscape continues to evolve, platforms like Lendbox are poised to reshape how individuals access credit and investors deploy their capital. However, it’s essential for users to approach P2P lending with a clear understanding of the risks and benefits. Conducting thorough research, assessing risk tolerance, and ensuring compliance with regulatory guidelines are crucial steps for both borrowers and investors looking to engage with platforms like Lendbox.

Conclusion

Lendbox stands as an influential player in the realm of peer-to-peer lending, offering a platform that empowers borrowers and investors alike. By leveraging technology, Lendbox simplifies the lending process, enhances transparency, and promotes financial inclusion by catering to a diverse range of individuals. Borrowers gain access to credit that might otherwise be inaccessible, while investors have the opportunity to diversify their portfolios and earn returns beyond traditional investments.

TagsLendingbox NBFC P2P LendingCopy URL URL Copied

Send an email 11/08/20230 78 3 minutes read

Share

Facebook X LinkedIn Tumblr Pinterest Pocket Skype Messenger Messenger ViberShare

Facebook X LinkedIn Tumblr Pinterest Reddit VKontakte Odnoklassniki Pocket Skype Share via Email Print