Payment Apps

-

Phonepe Refer and Earn

Phonepe Refer and Earn PhonePe is a popular digital payments platform in India that allows users to make payments, transfer money, recharge mobiles, pay bills and more. One of the most interesting features of PhonePe is its refer and earn program, which allows users to earn money by inviting their friends to use the app. What is PhonePe Refer and…

Read More » -

Amazon Pay later charges

Amazon Pay later charges Amazon Pay Later is a payment service that allows customers to make purchases on Amazon.in and pay later in installments. While this service can be helpful to those who need to make larger purchases but don’t have the funds immediately available, it’s important to understand the fees and charges associated with Amazon Pay Later. Firstly, it’s…

Read More » -

How to use Amazon pay later?

How to use Amazon pay later? Amazon Pay Later is a payment option that allows you to make purchases on Amazon and pay for them later. It’s a convenient way to shop without having to pay upfront. In this article, we’ll take a closer look at how to use Amazon Pay Later. Amazon Pay App : Download Now Step 1:…

Read More » -

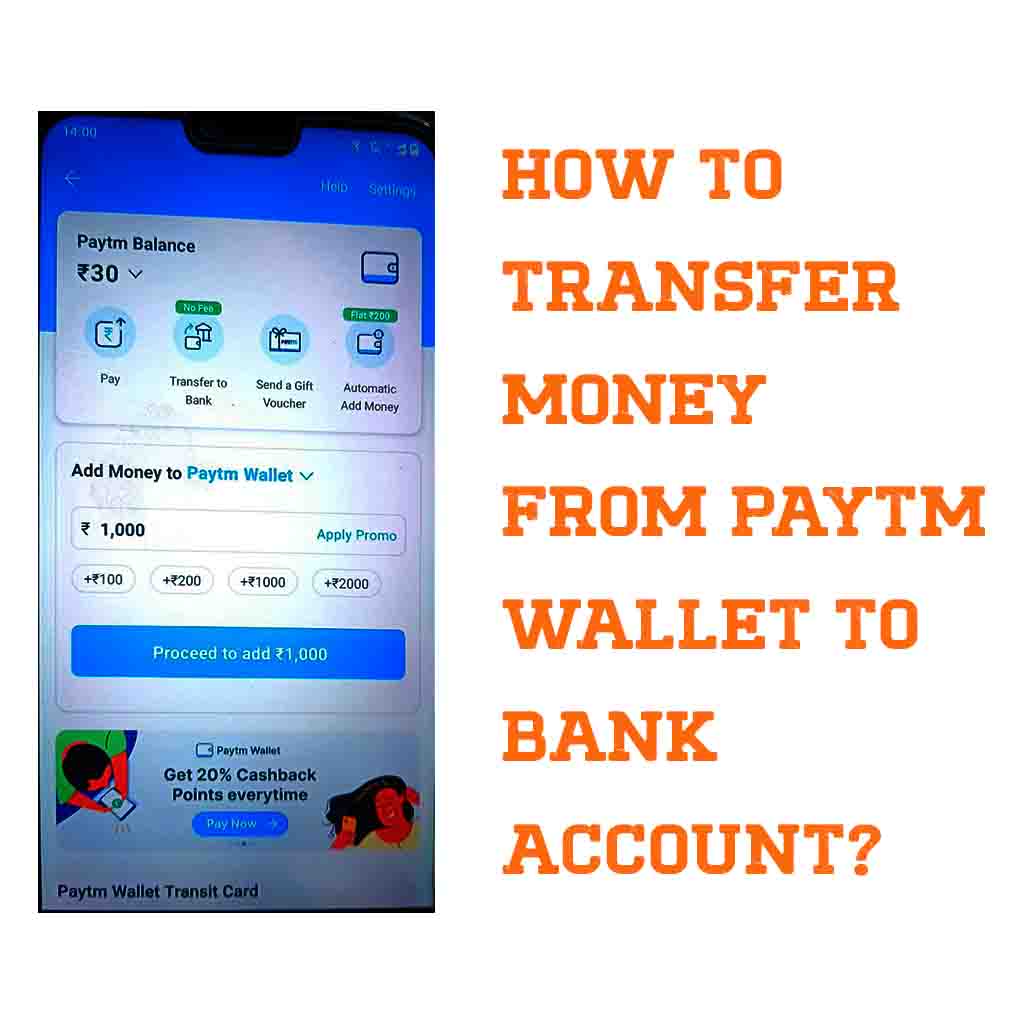

How to transfer money from Paytm wallet to bank account?

How to transfer money from Paytm wallet to bank account? How to transfer money from Paytm wallet to bank account? : In recent years, the adoption of mobile wallets has skyrocketed. Paytm, India’s leading mobile wallet provider, has been at the forefront of this revolution. Paytm has made it easy for people to make online payments, pay bills, and transfer…

Read More » -

Phonepe vs Paytm

Phonepe vs Paytm Phonepe vs Paytm : ये दोनों Payment Apps है। इन दोनों Apps में UPI (Unified Payment System) सर्विस कॉमन है और ज्यादातर लोग UPI का उपयोग करते है। फिर भी इन दोनों एप्पस में काफी अंतर है।

Read More » -

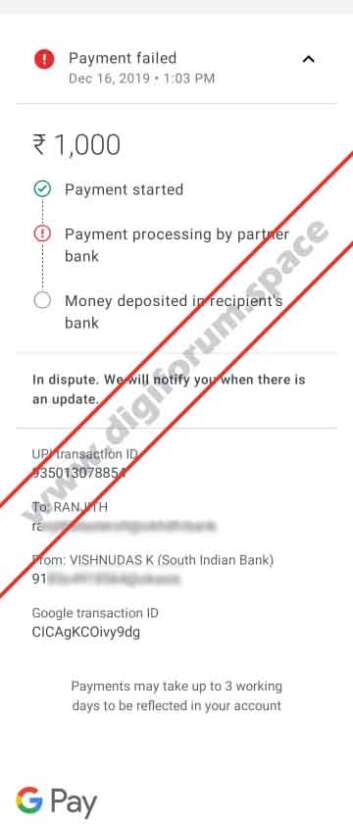

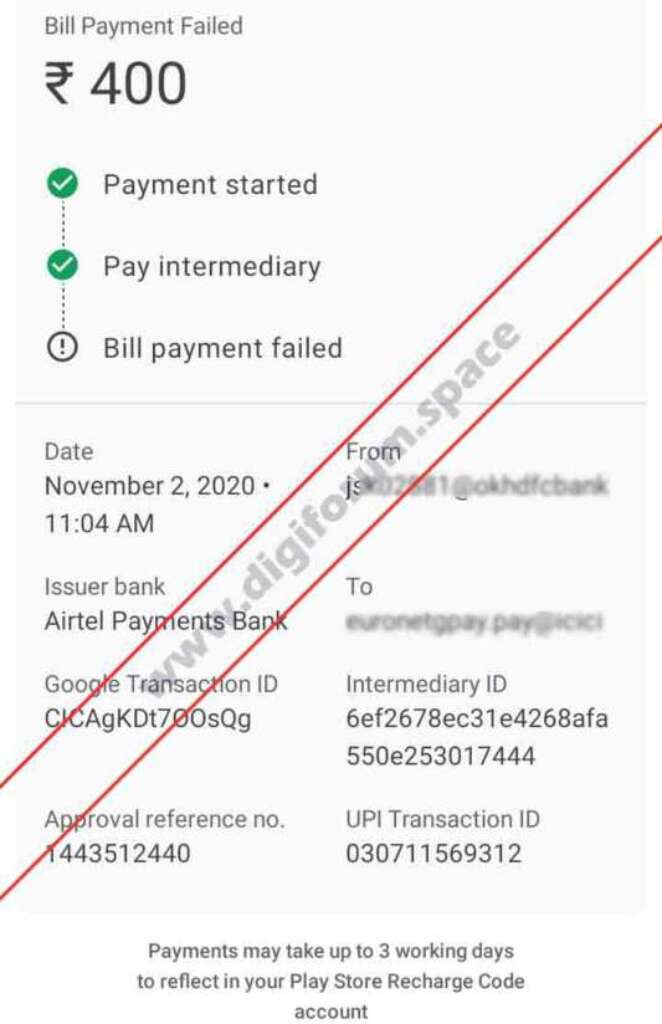

Transaction failed but money deducted from account Google Pay

Transaction failed but money deducted from account Google Pay Transaction failed but money deducted from account Google Pay : Google Pay (GPay) एक UPI App है, जिसे Google द्वारा India में लांच किया गया है। आप पहले से इस एप्प का उपयोग करते है, इसलिए इसके बारे में ज्यादा बताने की जरुरत नहीं है। बैंकों का सर्वर Up Down होते…

Read More » -

How to create UPI PIN without debit card in Phonepe

How to create UPI PIN without debit card in Phonepe How to create UPI PIN without debit card in Phonepe : Phonepe, Paytm या अन्य किसी भी Payment App में UPI Activate (बैंक अकाउंट लिंक करना) करने के लिए यूजर के बैंक अकाउंट से मोबाइल नंबर रजिस्टर्ड होना अनिवार्य है और वह सिम कार्ड मोबाइल के अंदर इनसेरटेड भी होना…

Read More » -

How to create UPI ID without Debit Card?

How to create UPI ID and PIN without Debit Card? How to create UPI ID? — आजकल प्रत्येक दुकानदार QR Code के माध्यम पेमेंट स्वीकार करते है। यह सबसे आसान भुगतान करने का तरीका है इसलिए UPI Apps अधिक ज्यादा यूज़ किये जाते है। इतना ही नहीं, UPI Apps का उपयोग करके अपने दोस्तों या परिजनों को Money Transfer Service…

Read More » -

UPI Transaction successful but money not credited

UPI Transaction successful but money not credited UPI Transaction successful but money not credited Refund Process : The Reserve Bank of India (RBI) issued a circular dated September 19, 2019, on the harmonisation of the Turn Around Time (TAT) and customer compensation in case of failed transactions. As per the circular, if the money debited from customer’s bank account does…

Read More » -

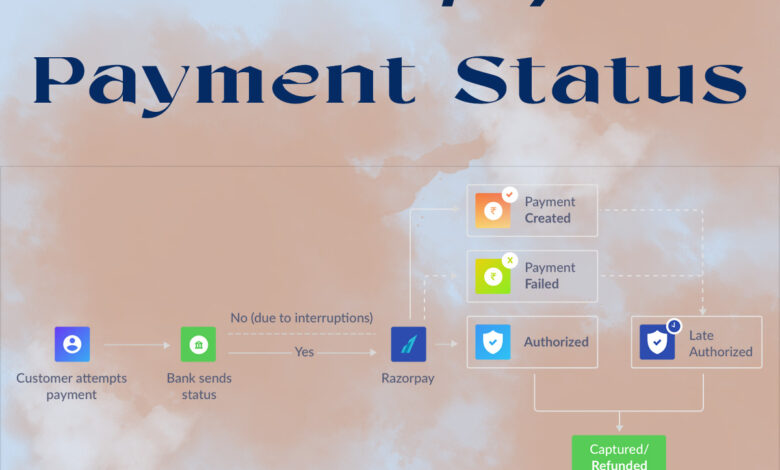

Razorpay Payment Status

Razorpay Payment Status यदि आप Razorpay Payment Gateway का उपयोग करते है, तो आपको उससे सम्बंधित सभी शब्दावली की जानकारी होना अति आवश्यक है। Created, Authorized, Captured, failed आदि शब्दों के सहायता से Razorpay पेमेंट का स्टेटस/स्थिति दर्शाता है। इस आर्टिकल हम इन सभी शब्दों का अर्थ विस्तार में समझने वाले है। इसे भी पढ़े : Online payment gateway in…

Read More »