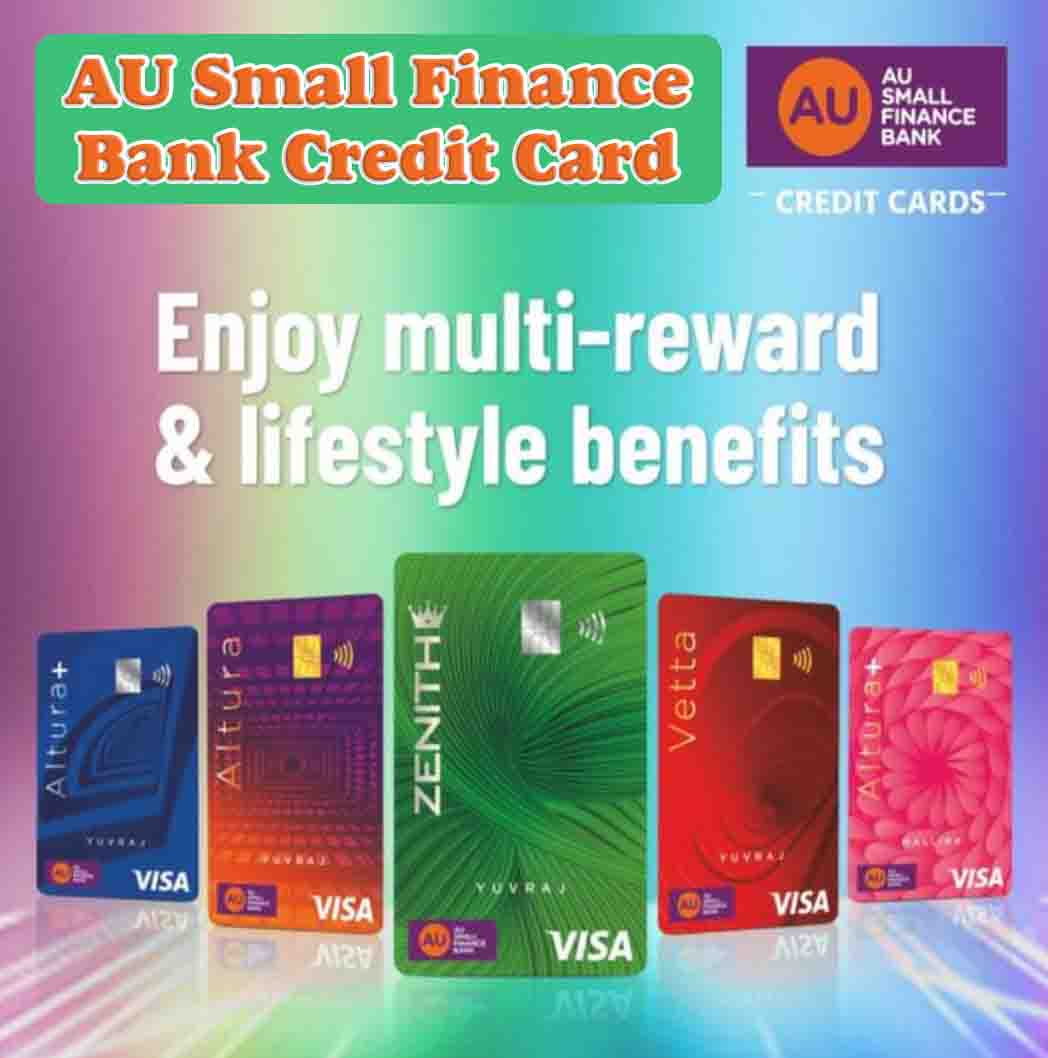

AU Small Finance Bank Credit Card

Credit cards have become an essential part of our daily lives. They offer convenience, security, and rewards that make transactions easier and more enjoyable. However, with so many options available in the market, it can be challenging to choose the right one for your needs. In this blog post, we will explore the features and benefits of the AU Small Finance Bank Credit Card and help you make an informed decision.

AU Bank Credit Card Benefits

AU Small Finance Bank is a new-age bank that offers a wide range of financial products and services, including credit cards. The bank’s credit card is designed to cater to the needs of individuals who seek convenience, flexibility, and rewards. Here are some of the features and benefits of the Credit Card:

Related Articles

1) Rewards and Cashback

The AU Bank Credit Card offers attractive rewards and cashback on every transaction. Cardholders can earn up to 3% cashback on fuel purchases, and 2% cashback on dining and entertainment. Additionally, cardholders can earn reward points up to 10X for every transaction made using the card, which can be redeemed for a variety of gifts and vouchers.

2) Zero Annual Fees:

The AU Bank Credit Card comes with no annual fees, which makes it an affordable option for individuals who want to enjoy the benefits of a credit card without incurring additional costs.

3) Contactless Payments:

This Credit Card is equipped with contactless payment technology, which allows cardholders to make quick and secure payments without the need for physical contact with the payment terminal. This feature is especially useful in the current pandemic situation, where hygiene and social distancing are of utmost importance.

4) EMI Options:

The AU Small Finance Bank also offers easy EMI options on purchases made using the card. Cardholders can convert their big-ticket purchases into easy monthly installments, which can help them manage their expenses better.

5) Paperless Application Process:

The application process for the AU Bank Credit Card is 100% digital and straightforward. Individuals can apply for the card online, and the approval process is quick and hassle-free.

6) Milestone Cashbak

7) Airport Launge Access

Eligibility

- Age should be beween 23 to 60 years.

- Locality : Metros and Tier 1 cities

- Salaried or Self Employed professionals with income level above 4 lakhs

- Cibil score should be 700 and above.

Apply Now

Documets

- PAN Card

- Aadhar Card

- Income Proof

Conclusion

The AU Bank Credit Card is an excellent option for individuals who seek convenience, flexibility, and rewards. With its attractive rewards and cashback offers, zero annual fees, contactless payment technology, easy EMI options, and simple application process, the card offers a range of benefits that make it a smart choice. So, if you are looking for a credit card that meets your needs, the AU Bank Credit Card is definitely worth considering.