UPI Transaction successful but money not credited

UPI Transaction successful but money not credited Refund Process : The Reserve Bank of India (RBI) issued a circular dated September 19, 2019, on the harmonisation of the Turn Around Time (TAT) and customer compensation in case of failed transactions. As per the circular, if the money debited from customer’s bank account does not reverse back to the bank account within the specified time period, due to a failed transaction, then the bank is liable to pay a penalty of Rs 100 per day to the customer.

IMPS Refund Time

As per the circular, in case of failure of an IMPS transaction where customer account is debited but the beneficiary account is not credited, auto-reversal must be done in T+1 day, where T refers to the transaction date. What it means is that if a transaction fails today, the amount should be credited back to the account of the person initiating the transaction by the end of next working day. If the bank does not credit the amount back to the customer’s account by T+1 day, then the bank is liable to pay a penalty of Rs 100 per day for the delay beyond T+1 day.

Related Articles

UPI Refund Time

Similarly, in case of transfer via UPI, where bank account is debited but beneficiary account is not credited, then auto-reversal must be done by the beneficiary bank by T+1. If not done, then penalty of Rs 100 per day beyond T+1 is levied.

In case you have experienced such a failed transaction you need to check the timeline allowed to your service provider to settle this issue. If they fail to do so within this timeline you need to lodge a complaint with your service provider or system participant. If they fail to resolve this issue within one month you can escalate the issue to the Ombudsman under The Ombudsman Scheme for Digital Transactions, 2019. You may reach out to your respective area Ombudsman here:

https://rbidocs.rbi.org.in/rdocs/Content/PDFs/AAOOSDT31012019.pdf.

Refund Time Period

Depending upon the nature of money transfer involved, RBI has given different settlement periods. Given below is the timeline of auto-reversal by the service provider and the compensation amount you are entitled to get in case of noncompliance by the service provider.

| Description of incident | Timeline of auto-reversal | Compensation payable |

| Customer account debited but cash not dispensed from ATM including micro-ATMs | Reversal of failed transaction within a maximum of T+5 days | Rs 100 per day for delay beyond T+5 days, to the credit of account holder. |

| Card account debited but beneficiary card account not credited in case of card to card transfer | Transaction to be reversed within T+1 day if credit is not effected to the beneficiary account | Rs 100 per day for delay beyond T+1 day |

| Account debited but confirmation not received at merchant location, i.e., charge-slip not generated | Auto-reversal within T+5 days | Rs 100 per day of delay beyond T+5 days |

| Transaction on e-commerce websites where account is debited but confirmation not received at merchant’s system | Auto-reversal within T+5 days | Rs 100 per day of delay beyond T+5 days |

| IMPS transaction – account debited but beneficiary account is not credited | If unable to credit, auto-reversal in T+1 day | Rs 100 per day if delay is beyond the T+1 day |

| Transfer of funds via UPI payments – Account debited but beneficiary account is not credited | If unable to credit to the beneficiary account, auto-reversal by the beneficiary bank by T+1 day | Rs 100 per day if delay is beyond T+1 day |

| Payment made to merchant via UPI – Account debited but transaction confirmation not received at merchant location | Auto-reversal within T+5 days | Rs 100 per day if delay is beyond T+5 days |

| Account debited but transaction confirmed not received at merchant location for payments made by Aadhaar Enabled Payment System including Aadhaar Pay | Acquirer to initiate “Credit Adjustment ” within T+5 days | Rs 100 per day if delay is beyond T+5 days |

| Account debited but beneficiary account not credited for payments made by Aadhaar Enabled Payment System including Aadhaar Pay | Acquirer to initiate “Credit Adjustment ” within T+5 days | Rs 100 per day if delay is beyond T+5 days |

| Delay in crediting beneficiary’s account for payments made via Aadhaar Payment Bridge System (APBS) | Beneficiary bank to reverse the transaction within T+1 day | Rs 100 per day if delay is beyond T+1 day. |

| Delay in crediting beneficiary’s account of reversal of amount for payment made via NACH | Beneficiary bank to reverse the uncredited transaction within T+1 day | Rs 100 per day if the delay is beyond T+1 day |

| Account debited despite revocation of debit mandate with the bank by the customer for NACH payments | Customer’s bank will be responsible for such debits. Resolution to be completed within T+1 day | Rs 100 per day if the delay is beyond T+1 day |

| Payments made via card or mobile wallets where two different banks are involved, then such transactions will be done using UPI, debit/card, IMPS etc. | Reversal of money in such cases will be done as mandated by UPI, Card or IMPS as mentioned above. | Compensation will be paid accordingly as per the method used to make payment |

| Payments made via card or mobile wallet but beneficiary account is not credited ; the transaction is done within the same bank or same mobile wallet | Reversal to de done in Remitter’s (initiator) account within T+1 day | Rs 100 per day if delay is beyond T+1 day |

| Payment made via card or mobile wallet but transaction confirmation not received at the merchant location for payment done within the same bank or same mobile wallet | Reversal to de done in Remitter’s (initiator) account within T+1 day | Rs 100 per day if delay is beyond T+1 day |

FAQS – Frequently Asked Questions

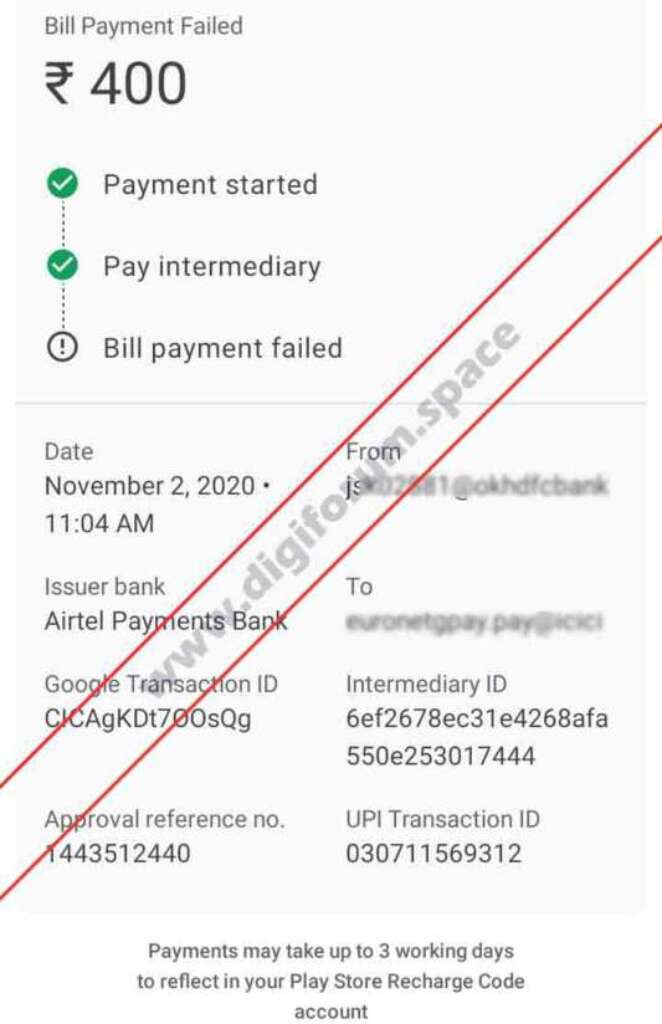

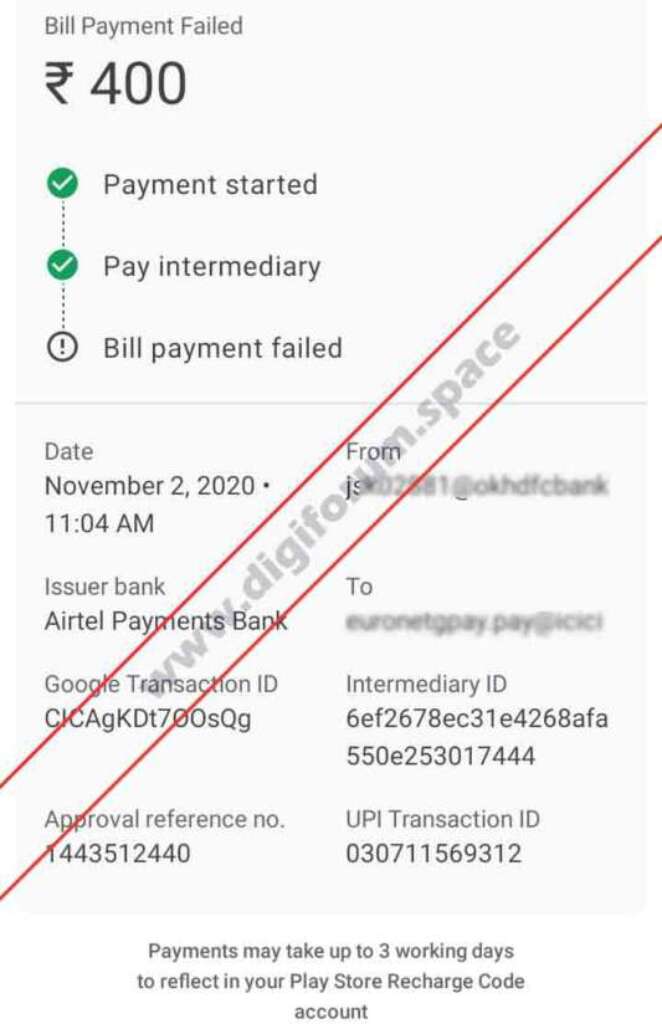

Q1: What does it mean when a UPI transaction is successful but the money is not credited?

A1: When a UPI transaction is marked as successful but the money is not credited, it means that the funds have not been transferred to the intended recipient’s account.

Q2: Why does it sometimes happen that a UPI transaction shows as successful but the money doesn’t appear in the recipient’s account?

A2: There could be various reasons for this discrepancy. It could be due to technical issues, network connectivity problems, or errors during the transaction process.

Q3: What should I do if my UPI transaction was successful but the money is not credited?

A3: If you encounter such a situation, it is advisable to take immediate action. Start by checking the transaction status in your UPI app and verifying the recipient’s details. If the money is still not credited, you should contact your bank’s customer support or the UPI service provider for assistance.

Q4: How long should I wait before taking action if my UPI transaction is successful but the money is not credited?

A4: It is recommended to wait for a reasonable amount of time, usually up to 24 to 48 hours, for the funds to be credited. If the issue persists beyond this timeframe, it’s best to reach out to the relevant customer support for resolution.

Q5: Is it possible for a UPI transaction to be successful without the money being credited due to technical issues?

A5: Yes, technical issues can sometimes cause delays or failures in the crediting of funds, even if the UPI transaction appears successful. It’s crucial to report such incidents to the concerned authorities for investigation and resolution.

Q6: Are there any common reasons why a UPI transaction may show as successful but the money is not credited?

A6: Yes, common reasons for this discrepancy include incorrect or incomplete recipient details, technical glitches in the payment system, network failures, or delays in the recipient bank’s processing of the transaction.

Q7: Can the recipient bank reject or delay the credit of the UPI transaction even if it shows as successful?

A7: In certain cases, the recipient bank may have internal processes that require additional verification or manual intervention before crediting the funds. This could result in a delay or potential rejection of the transaction, despite it appearing successful initially.

Q8: What steps can I take to resolve the issue of a successful UPI transaction with no credited money?

A8: To resolve the issue, start by contacting your bank or the UPI service provider’s customer support helpline. Provide them with all the transaction details, including transaction ID, recipient’s details, and any relevant screenshots. They will guide you through the necessary steps to investigate and resolve the matter.

Q9: Is it necessary to contact customer support if my UPI transaction is successful but the money is not credited?

A9: Yes, it is crucial to contact customer support in such cases. They have the expertise to investigate the issue, communicate with the relevant banks, and help resolve the discrepancy. Their assistance can increase the chances of recovering the funds successfully.

Q10: Are there any precautions I can take to avoid UPI transactions showing as successful but the money not being credited?

A10: While issues can still occur despite precautions, you can minimize the chances of facing such problems by:

1. Double-checking the recipient’s UPI ID or bank account details before initiating a transaction.

2. Verifying your own bank balance and ensuring sufficient funds are available for the transaction.

3. Using a stable and reliable internet connection to avoid connectivity issues.

4. Keeping transaction receipts, reference numbers, and other relevant details for future reference and dispute resolution, if needed.