Banking And Finance

-

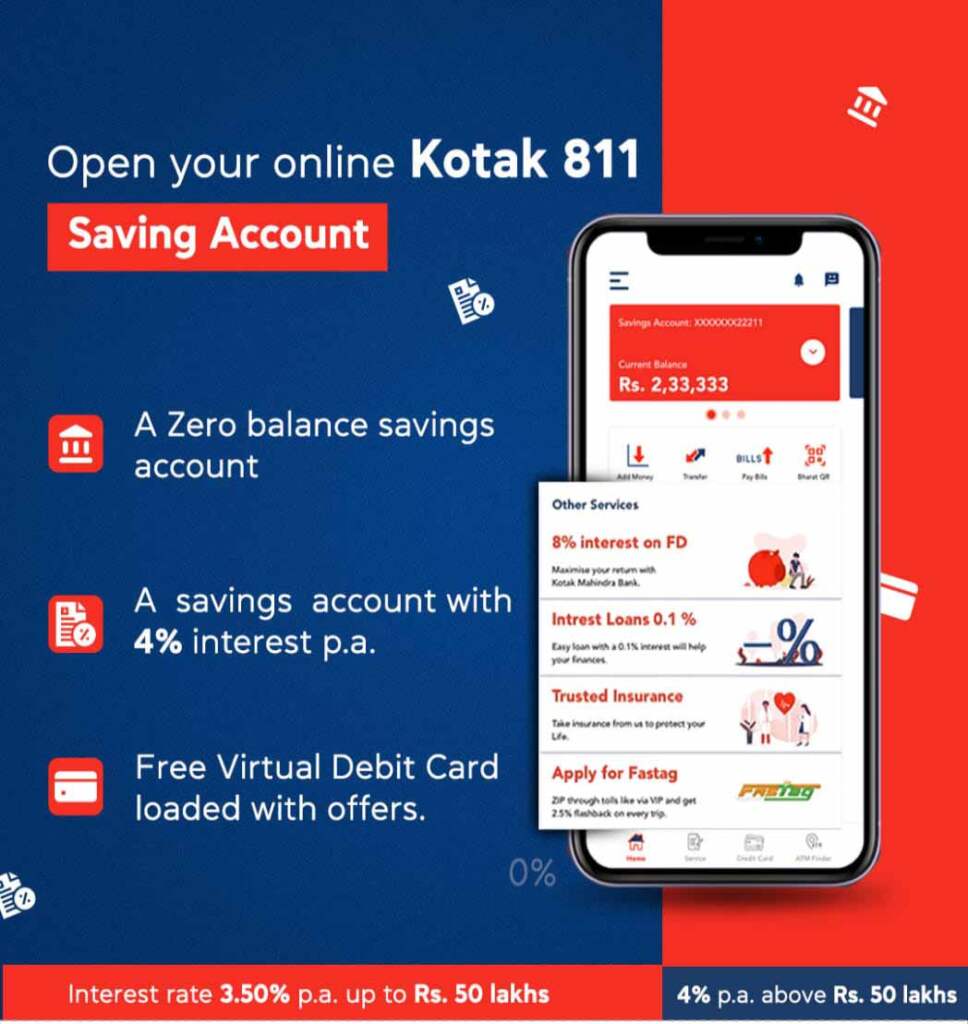

Kotak Mahindra Bank 811 Account Open

Kotak 811 Savings Account: Instantly Open a Zero Balance Savings Account and Unlock up to 4% Interest” Kotak Mahindra Bank 811 Account Open: In today’s fast-paced world, convenience is key, especially when it comes to managing our finances. That’s where digital banking comes into play, offering us the ease and flexibility we need. One such offering is the Kotak 811…

Read More » -

Under Liquidation meaning in Banking

Liquidation in Banking Liquidation is a term often associated with distress and financial turmoil. In the realm of banking, it carries significant weight and consequences. It’s a process that can impact not only financial institutions but also individuals and the broader economy. In this article, we will delve into the meaning of liquidation in banking, its implications, and provide a…

Read More » -

Quick Money is the Term Associated with HDFC Bank

Quick Money and HDFC Bank In a world where time is of the essence and financial opportunities abound, the association of “Quick Money is the Term Associated with HDFC Bank” holds immense significance. This article embarks on a journey to uncover the dynamic synergy between swift financial growth and the innovative offerings of HDFC Bank. As the financial landscape evolves,…

Read More » -

Royal Sundaram Finance

Discovering Financial Confidence with Royal Sundaram Finance In the fast-paced world of finance, finding a reliable partner is crucial for achieving your financial goals. Enter Royal Sundaram Finance – a name that resonates with trust, reliability, and a commitment to your financial well-being. If you’re new to the world of financial services or considering exploring new avenues, this beginners guide…

Read More » -

Financial Inclusion in India

Financial Inclusion in India In a nation as vast and diverse as India, ensuring that all segments of the population have access to financial services and opportunities is a formidable challenge. However, the pursuit of financial inclusion has gained momentum over the years, with concerted efforts from the government, financial institutions, and technological advancements. In this comprehensive article, we’ll explore…

Read More » -

Online Payment methods in India

Online Payment methods in India In the rapidly evolving landscape of digital transactions, India has witnessed a remarkable shift from traditional cash-based payments to the convenience of online payment methods. With the government’s push for a digital economy and the proliferation of smartphones, online payment methods have become an integral part of everyday life for millions. In this comprehensive guide,…

Read More » -

How Online Transaction Works?

How Online Transaction Works? In today’s digital age, the convenience of online transactions has revolutionized the way we handle our finances. Whether it’s purchasing goods, paying bills, or transferring money to a friend, the process of online transactions has become an integral part of our daily lives. But have you ever wondered how money seamlessly flows from one account to…

Read More » -

Recurring Deposit VS Fixed Deposit

Recurring Deposit vs. Fixed Deposit: Making Informed Savings Decisions When it comes to investing your hard-earned money, there are various options to consider, each with its own set of advantages and limitations. Two popular choices that often stand out are Recurring Deposits (RDs) and Fixed Deposits (FDs). These financial instruments provide a secure way to grow your savings while earning…

Read More » -

What is RD (Recurring Deposit) in Bank ?

What is Recurring Deposit? In the world of finance, there are various investment avenues available to individuals looking to grow their savings. One such option that often appeals to those seeking a disciplined approach to saving is the Recurring Deposit (RD). A recurring deposit is a popular financial instrument offered by banks and financial institutions that allows individuals to save…

Read More » -

What is RD Service in Jeevan Pramaan

What is RD Service in Jeevan Pramaan: The Backbone of Aadhar Biometric Authentication What is RD Service in Jeevan Pramaan: In an era where security and identity verification are of paramount importance, Aadhar authentication stands as a beacon of reliability in India. At the heart of this robust system is the Registered Device (RD) Service, a technological marvel that ensures…

Read More »