How to Register for Atal Pension Yojana Scheme: A Step-by-Step Guide

Atal Pension Yojana Registration : Atal Pension Yojana (APY) is a pension scheme launched by the Government of India to provide financial security to people in the unorganized sector. The scheme is open to all Indian citizens between the ages of 18 and 40 years who have a savings bank account and are not covered under any statutory social security scheme. In this blog post, we will discuss how to register for the Atal Pension Yojana scheme in a step-by-step guide.

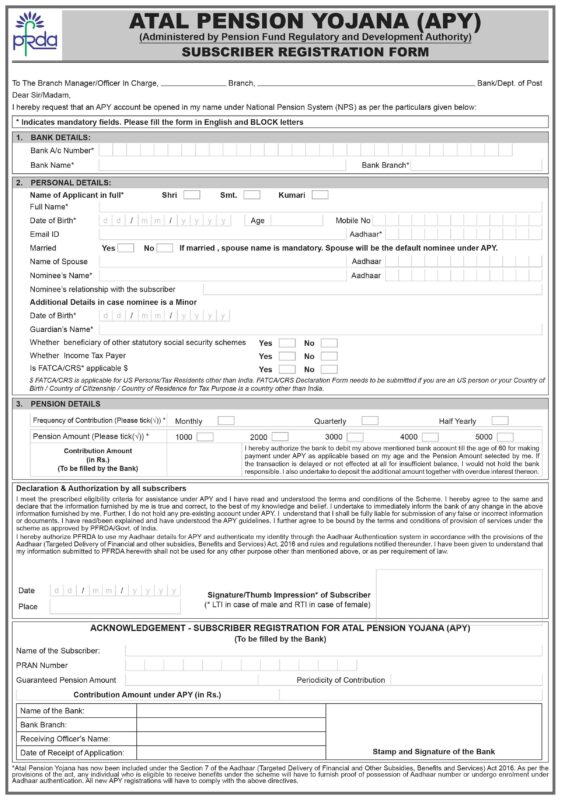

ATAL PENSION YOJANA APPLICAION FORM PDF – DOWNLOA NOW

Step 1: Visit your bank

The first step in the Atal Pension Yojana Registration process is to visit your bank. The APY scheme is available through banks and post offices. You can choose any bank or post office of your choice to register for the scheme. The bank officials will guide you through the process and help you fill out the necessary forms.

Step 2: Provide the necessary documents

The next step is to provide the necessary documents. You will need to provide your Aadhaar number, bank account number, and a mobile number registered with Aadhaar. If you do not have an Aadhaar card, you will need to provide an alternative valid ID proof such as a PAN card or a voter ID card.

Step 3: Choose the pension amount

The third step is to choose the pension amount you want to receive after retirement. The pension amount ranges from Rs. 1000 to Rs. 5000 per month, depending on the contribution made and the age of the subscriber at the time of joining.

Step 4: Choose the contribution frequency

The fourth step is to choose the contribution frequency. The subscriber can choose to contribute on a monthly, quarterly, or half-yearly basis, depending on their convenience.

Step 5: Authorization

The final step is to sign the authorization form. This form authorizes the bank to deduct the contribution amount from your bank account and deposit it into your APY account.

Related Articles

Conclusion

In conclusion, registering for the Atal Pension Yojana scheme is a simple and straightforward process. By following the above steps, you can easily register for the scheme and secure your retirement. The scheme offers a guaranteed pension to its subscribers, and the pension amount depends on the contribution made and the age of the subscriber at the time of joining. If you are between the ages of 18 and 40 years and do not have access to any formal pension scheme, you should consider registering for the Atal Pension Yojana scheme and secure your financial future.