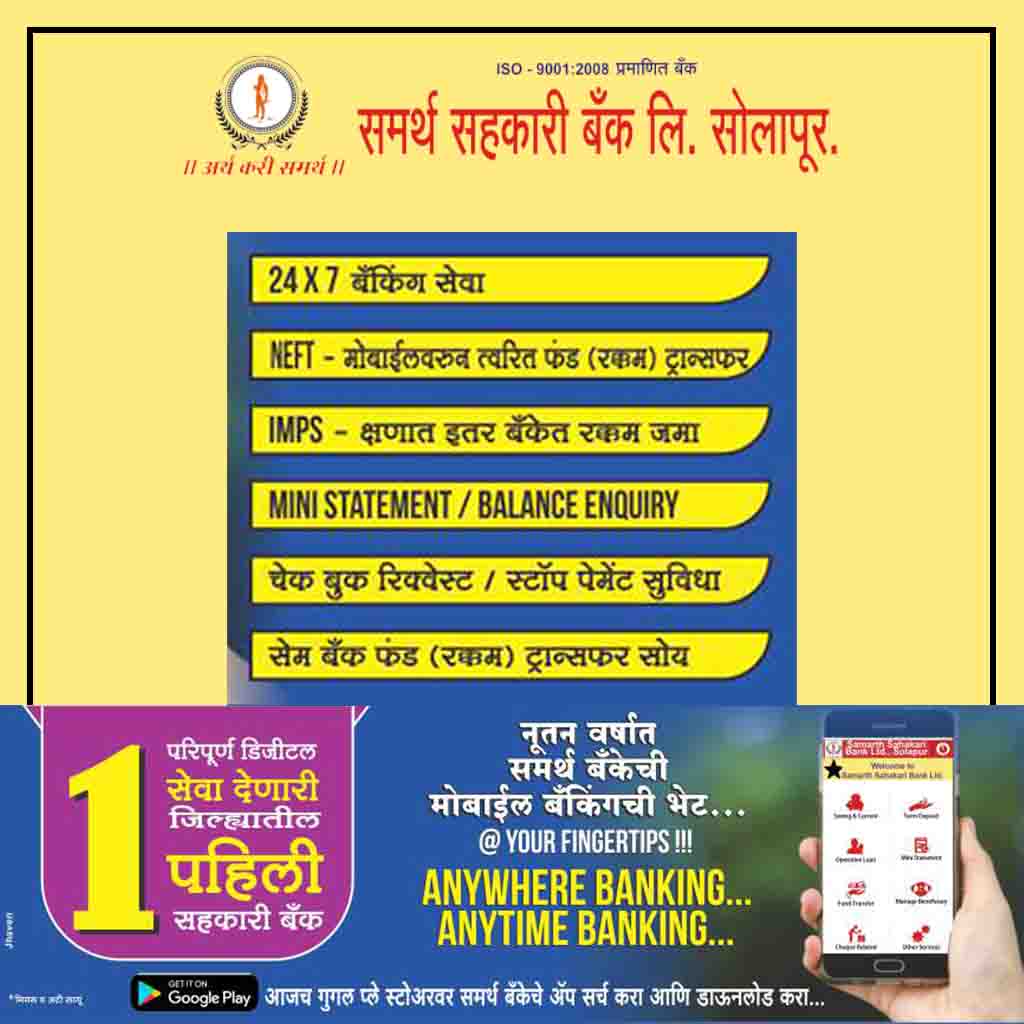

Samarth Sahakari Bank Interest Rates

As individuals, we all strive to make the most of our hard-earned money, and one of the key aspects of financial planning is finding the right savings and investment options. For many, banks play a vital role in securing their funds while earning a return on their savings. Among the various banks available, Samarth Sahakari Bank stands as a reliable option, offering competitive interest rates on deposits. In this blog article, we will explore the interest rates offered by Samarth Sahakari Bank, shedding light on the different types of accounts and investment options that can help you maximize your savings.

The Importance of Interest Rates

Interest rates play a crucial role in shaping the returns on your savings and investments. Whether it’s a savings account, fixed deposit, or any other financial instrument, the interest rate determines the growth potential of your money over time. Higher interest rates can lead to faster wealth accumulation, making it essential to choose a bank that offers competitive rates. Samarth Sahakari Bank understands the significance of interest rates for its customers and strives to provide attractive returns, making it a preferred choice for depositors.

Related Articles

Interest Rates on Savings Accounts

Savings accounts are the most common way for individuals to park their funds while maintaining liquidity. Samarth Sahakari Bank offers competitive interest rates on its savings accounts, allowing customers to earn a nominal return on their balances. The interest rates on savings accounts are subject to change based on market conditions and the bank’s policies, but rest assured, Samarth Sahakari Bank remains committed to providing attractive returns to its account holders.

Fixed Deposit (FD) Interest Rates

Fixed Deposits (FDs) are a popular investment option for risk-averse individuals seeking stable returns on their savings. Samarth Sahakari Bank offers various FD options with varying tenures and interest rates. Typically, FD interest rates are higher than those offered on savings accounts, providing a better opportunity to grow your money with minimal risk.

The FD interest rates at Samarth Sahakari Bank may vary depending on factors such as the deposit amount and the chosen tenure. Generally, longer tenures and larger deposits attract higher interest rates. It’s important to note that FD interest rates remain fixed throughout the chosen tenure, shielding you from fluctuations in market rates during that period.

Recurring Deposit (RD) Interest Rates

Recurring Deposits are an ideal option for those who want to save regularly and earn interest on their monthly contributions. At Samarth Sahakari Bank, RDs come with competitive interest rates, making it an attractive option for disciplined savers. RD interest rates are subject to revision based on market conditions, but once you open an RD account, your interest rate remains constant for the entire tenure.

High Returns on Senior Citizen Deposits

Samarth Sahakari Bank acknowledges the financial needs of senior citizens and offers special interest rates on fixed deposits for this age group. The senior citizen deposit scheme provides higher returns on their investments, allowing them to preserve their savings while earning attractive interest income.

Savings Account : 3%

Factors Affecting Interest Rates

Interest rates offered by Samarth Sahakari Bank, like any other financial institution, are influenced by several factors. Some of these factors include prevailing economic conditions, inflation rates, monetary policies, and the bank’s liquidity requirements. Additionally, competition from other banks can also impact the bank’s decision to revise interest rates.

Rate of Interest on FD

| Particulars | Regular ROI | Sr.Citizen / Bulk Deposit Above 15 Laks ROI |

| 30 to 180 Days | 3% | 3.50% |

| 181 to 364 Days | 5.25% | 5.75% |

| 1 Year to less than 2 Years | 6.80% | 7.30% |

| 2 Year to 3 Years | 7% | 7.50% |

| Above 3 Year | 6.50% | 7% |

Interest Rate on Loan Products

| Sr.No. | Particular | Rate of Interest | Picture |

| 1 | Housing Loan | 14% | e.g.House |

| 2 | Education Loan-Secured – Unsecured | 14% – 15% | |

| 3 | Vehicle Loan ( Atmanirbhar ) | 12% | |

| 4 | Hypothecation Loan- ( Cash credit ) | 13% ( Except contractor and real estate ) | |

| 5 | Term Loan | 12% ( Except contractor and real estate ) | |

| 6 | Builders & Contractors Loan | 16% and 15.50% | |

| 7 | Personal / Clean Loan ( For Education Fee , Marriage and Medical Reason’s ) | 15.50% | |

| 8 | Personal / Household product loan ( Other than Above Reason ) | 18% | |

| 9 | Deposit Against Loan(Advance Against FD/RD, Overdraft against FD) | Extra 1% of FD ROI | |

| 10 | Deposit Against Loan(Advance Against FD/RD, Overdraft against FD) on Third party FD | Extra 1% of FD ROI | |

| 11 | Gold Loan EMI Gold Loan ( Bullet ) | 13% 10% | |

| 12 | Pigmi Loan | 11% | |

| 13 | Group Clean Loan | 15.50% |

For additional information : Click Here

Conclusion

In conclusion, Samarth Sahakari Bank offers competitive interest rates on various deposit accounts, providing customers with an opportunity to earn attractive returns while maintaining financial security. Whether you choose a savings account, fixed deposit, or recurring deposit, the bank’s commitment to providing competitive interest rates remains constant. As a prudent investor, it’s essential to regularly check for updates on interest rates and explore the different deposit options to maximize your savings and achieve your financial goals. Always consider your risk tolerance, investment horizon, and liquidity requirements while making informed decisions about your savings and investments with Samarth Sahakari Bank.