As one of the leading AePS Service Providers in India, PayNearby has garnered over one crore downloads on the Play Store. Their interface and commitment to financial inclusion have solidified, their reputation among individuals seeking smooth financial transactions. But what if we told you that there’s a way to elevate your PayNearby experience and increase your earnings? This is where the PayNearby Referral Code comes in. This guide will help you learn details of the PayNearby Referral Code. Also you will learn how you can leverage it for your benefit.

What is Paynearby Referral Code

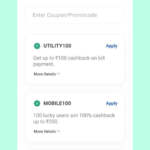

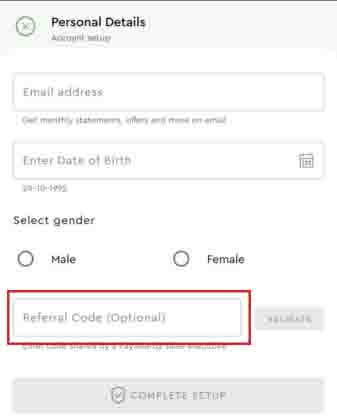

The referral code of Paynearby can be used at the time of registration, It is available only once at the registration. Only new Retail agents can get discount of Rs. 100 or more (based on Paynearby offer). Further retail agents can share their Referral code with friends, relatives or on social media. Please note that the registered mobile number becomes a referral code and by using referral code, new retailers get Rs. 100 off on the Package (Financial Services) Upgradation.

Here is my Paynearby Referral Code

If you are a onboarding yourself on Paynearby and want add a referral code, then you can use my Paynearby referral code given below, I am a Paynear user from 2017 as Retailer and Distributor.

Paynearby Referral Code 2024

Paynearby Referral Code: 9422030311

Next Step: How to upgrade paynearby package?

How to find Paynearby Referral Code?

If you are an existing retailer of Paynearby and want to share your referral code with your friends, but you don’t know what your referral code is. Here is the guide that will help you to find Paynearby Referral code. The referral code of a Paynearby is nothing but the registered mobile number in the Paynearby App. For instance, I have created a retailer ID using my mobile number 9422030311, then my referral code will be 9422030311. You can find these details in section “Refer & Earn -> Link Share” Paynearby App.

Related Articles

FAQs – Frequnetly Asked Questions

Q. What is PayNearby?

Ans. PayNearby is a fintech company in India dedicated to making financial services accessible to all, regardless of their geographical location or socio-economic background.

Q. What services does PayNearby offer?

Ans. PayNearby provides a variety of services, including banking services, digital payments, money transfers, insurance services, Aadhaar Enabled Payment System (AEPS), and micro-ATM services.

Q. Can I open a bank account through PayNearby?

Ans. Yes, you can easily open a bank account using PayNearby, which gives you access to a wide range of financial services.

Q. How can I use the PayNearby Referral Code 2024 for benefits?

Ans. To use the PayNearby Referral Code, simply enter the code ‘9422030311’ during the registration process to get benefit of Rs. 100 on package upgrade.

Q. What is the Aadhaar Enabled Payment System (AEPS)?

Ans. AEPS is a system that allows you to perform banking transactions conveniently using your Aadhaar number.

Q.Can I make utility bill payments through PayNearby?

Ans. Yes, PayNearby allows you to make utility bill payments, simplifying your monthly financial obligations.

Q.What are the benefits of becoming a PayNearby agent?

Ans. Becoming a PayNearby agent enables you to participate in financial inclusion efforts, empower local communities, and potentially generate income through commission-based services.

Q.Are PayNearby’s services available in rural areas?

Ans. Yes, PayNearby collaborates with local retailers and agents to extend financial services to remote areas, fostering economic growth and empowerment within local communities.

Q.How can I upgrade my PayNearby package?

Ans. To upgrade your PayNearby package, you can likely find information and instructions on the PayNearby App or read following article -> Paynearby Package Upgrade.

Wrapping Up

In a world where financial services are often out of reach for many, PayNearby, stands as a beacon of hope and transformation. Through its innovative model, it has brought banking and financial services to the doorsteps of millions. As PayNearby continues to evolve and adapt, it is set to play a pivotal role in shaping a more inclusive India.

Whether you are an aspiring entrepreneur looking to become a PayNearby agent or an individual seeking accessible financial services, PayNearby is a name to watch in the ongoing fintech revolution.