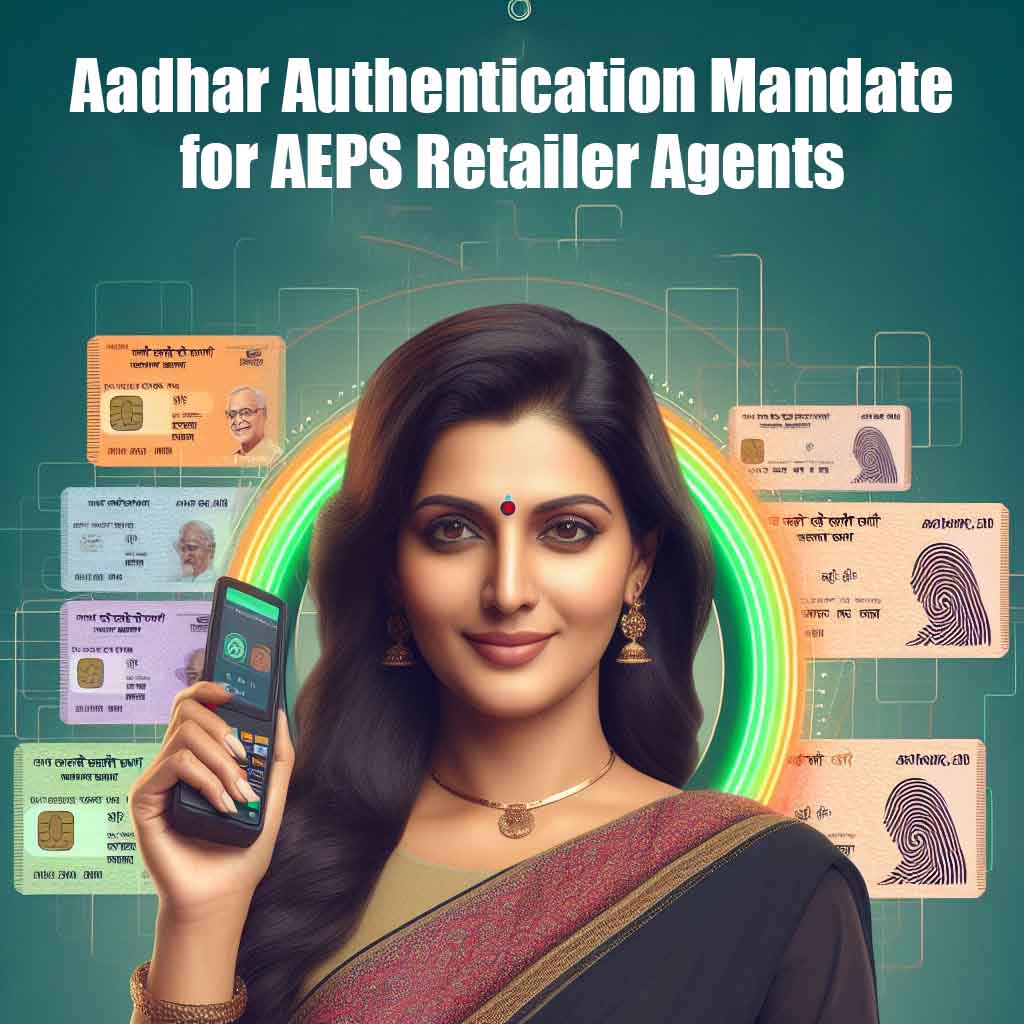

In a significant move towards fortifying the security of financial transactions in the digital space, the National Payments Corporation of India (NPCI) has introduced a new regulation for AEPS (Aadhar Enabled Payment System) Retailer Agents. The recent mandate requires retailers to undergo a self-verification process through biometric Aadhar authentication for every Aadhar Cash withdrawal transaction they facilitate. This step aims to not only enhance the security of transactions but also ensures the integrity of the AEPS ecosystem.

The Need for Enhanced Security:

As technology continues to play a pivotal role in shaping the future of financial transactions, the potential risks associated with digital platforms have become a growing concern. With the increasing adoption of AEPS for financial transactions, ensuring the security and authenticity of each transaction has become imperative. The new NPCI regulation acknowledges this need and takes a proactive step towards mitigating potential risks.

Key Features of the Regulation:

The primary focus of the regulation lies in the self-verification process that retailers must undergo using biometric Aadhar authentication. This process adds an additional layer of security, making it more difficult for unauthorized individuals to engage in fraudulent activities. By linking each transaction to the biometric data of the retailer, the system aims to establish a secure and foolproof method for identity verification.

Understanding the Biometric Aadhar Authentication:

Biometric Aadhar authentication involves the use of an individual’s unique biometric characteristics, such as fingerprints or iris scans, to verify their identity. In the context of AEPS Retailer Agents, this means that before facilitating any Aadhar Cash withdrawal, retailers must authenticate themselves using their biometric data. This process not only ensures the authenticity of the agent but also creates a traceable link between the transaction and the individual facilitating it.

Benefits of the Regulation:

- Increased Security: The introduction of biometric Aadhar authentication adds an additional layer of security, making it more challenging for unauthorized entities to engage in fraudulent activities.

- Improved Trust: With enhanced security measures, users are likely to have greater confidence in the AEPS system, leading to increased adoption and usage.

- Reduced Fraud: The traceability provided by biometric Aadhar authentication reduces the likelihood of fraudulent transactions, creating a safer environment for financial dealings.

- Regulatory Compliance: Retailers adhering to this regulation demonstrate their commitment to compliance with industry standards, contributing to the overall integrity of the financial ecosystem.

Challenges and Considerations:

While the new regulation brings forth numerous benefits, it is essential to acknowledge potential challenges. Retailers may face initial hurdles in adapting to the new authentication process, and there could be concerns regarding the storage and protection of biometric data. Addressing these challenges will be crucial for the successful implementation of the regulation.

Conclusion:

The NPCI’s decision to mandate biometric Aadhar authentication for AEPS Retailer Agents represents a commendable step toward bolstering the security of financial transactions. As the digital landscape evolves, it is essential to adopt proactive measures that not only keep pace with technological advancements but also prioritize the protection of user data and financial assets. The AEPS ecosystem is set to benefit significantly from this regulation, as it creates a more secure and trustworthy platform for users and retailers alike.